Some Cambridge residents may qualify to get out of paying a significant portion of their tax debt

Are you one of them? Our BBB A+ pros can tell you within 15 minutes over the phone

Take the 59sec Tax Savings Calculator Now to Find Out:

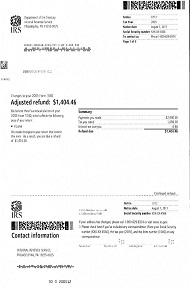

Verified Client Results:

100% US-Based Staff

Proudly Serving Cambridge, and All of Massachusetts

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Finally put an end to your tax debt problems, give our firm a call today

Highly Experienced Cambridge Tax Lawyer

One of many key difficulties that Cambridge citizens run into in relation to IRS back taxes is feeling overwhelmed and anxious about the money that they owe. With the IRS sending threatening letters and notices, revenue officers, and even taking away cash property and assets, it might be an extremely chilling experience.

We believe that no one should have to go up against the IRS alone anymore.

It’s only not fair what they put ordinary tax payers through, and we consider they must not get away with it.

That means you do not pay a penny for the total use of our experienced team for a complete week.

30 Day Money Back Guarantee that is on top of our no questions asked. In case you aren’t satisfied for any reason with our service, just let us know within 30 days, and you’ll get all of your money back.

What are you waiting for? The longer that you wait and put it away, the more fees and interest charges the IRS will tack on to the amount that you owe. Take action and call our Cambridge team a call now to get started!

Give our office a call today!

It's time to quit the sales officers from harassing you, once and for all!

What is an IRS Revenue officer?

Agent or an IRS officer is a typical visitor to daily life or your Massachusetts business. Getting a differentiation between the two is very important that you learn how exactly to deal with each. An IRS agent has the principal purpose of auditing tax returns. They send notifications regarding impending audits via email. You can go to local IRS office, when you get an email from IRS representative or an agent comes over to your house or company to audit returns.

An IRS officer on the other hand deals with more complicated tax issues. For instance, if an IRS representative discovers that you haven’t paid taxes on a specific source of income, your case is called IRS officer. Hence the primary occupation of an IRS official would be to handle a tax debt or back tax liability. The key differentiation between the two is that whereas an agent checks to confirm that you’ve filled the right tax liability, an IRS officer merely enforces delinquent taxes to collect from you.

The IRS assigns you a revenue officer in these conditions:

Failure to Collect Tax Debts

When the IRS has failed to collect taxes from you using the regular channels like e-mails, levies, notices and telephone calls.

Un-Filed Back Tax Returns

When you’ve got a reputation of not filling taxes.

When you neglect to pay particular kind of taxes like payroll taxes.<?p>

Huge Outstanding Tax Liabilities

When your tax liability is substantially large, a typical figure being or more 25,000.

Remember IRS revenue officers are mandated by law to undertake measures to recover the taxes. These measures may include problem levies, confiscate and repossess property, freeze assets or wage garnishments. Expect these officers to show up at your residence or place of businesses sudden or without prior communication. In rare cases, the officers might phone you or send you emails summoning you to their offices. Make an effort to work with them to avoid further complicating your case and try to pay you delinquent taxes to the expand your income can accommodate. If your case is more complicated or the tax amount needs you to work out a plan to pay, you’ll need the services of a lawyer.

What You Should Do if you Face {a Revenue Officer|an IRS Revenue Official

When you’re not able to settle your debt immediately, the IRS official might request some files and financial records. Such information like form 9297 which is send to you personally by the IRS, form 433-A which is used for people or form 433-B which is used for businesses are used by the Internal Revenue Service to identify your income, assets, and give an overview of your obligations. Filling these forms ought to be done right and precisely hence the professional services of an attorney are needed. Thus, as soon as you get these forms, the very first thing to do would be to telephone legal counsel.

Also, a lawyer in Cambridge will review your financial situation and work out the best paying strategy with all the IRS revenue officials. Without an attorney, the IRS policemen might intimidate you into agreeing to a strategy that you cannot afford but which makes their job easier. A lawyer is able to quickly negotiate and get you a adaptive one, should you be given tight datelines. Remember, there are many alternatives that may be offered by the officer. A common one in case related to payroll overdue is to evaluate and assign you a retrieval fee trust fund. For this to take place, an interview should be conducted to ascertain who is the real offender between a person and also a business and having an attorney in this interview in Massachusetts is a matter of necessity.

Let our attorneys deal with the IRS and state of Massachusetts, in order to focus on running your business.

The Internal Revenue Service is a formidable collection machine for the Federal Government, and when your Cambridge company has fallen into IRS or Massachusetts business tax debt, they are going to accumulate. Thus, in case your company has overdue taxes like payroll tax debts there’s no need to scurry for cover (and remember – never hide) even should you know little or nothing about dealing with IRS business tax debts. There are experienced professionals ready to assist.

Un-Filed PayRoll Tax Filings

The Internal Revenue Service looks at payroll tax – taxes imposed on employers and workers – from two standpoints:

- (a) Taxes a company pays the IRS predicated on the wages paid to the employee (known as withholding tax’ and is paid out of the companies own funds) and

- (b) A percentage of wages the employer deducts from an employee’s wages and pays it to the Internal Revenue Service.

The employer ends up footing the bill for both the forms of taxes as the withholding tax results in lower wages.

Tax Repayment Schedule

Employment or Payroll taxes are collected by the Internal Revenue Service through the Electronic Federal Tax Payment System (EFTPS). This payment program may be monthly or semiweekly.

In the event that you are a business that is new and didn’t have some employees during your look back interval’ or in case your total tax liability is up to USD 50,000 for your appearance back interval’, you must follow a monthly program. Your payroll taxes should be deposited by the 15th of the month following the last payday.

In case your payroll tax liability is less than USD 50,000 you will have to follow a semi-weekly deposit program. You will fall into a payroll tax debt, if you fail to pay your taxes on these days. You should seek the services of tax professionals to direct you through this labyrinth of procedures and keep from falling into payroll tax debt and give a wide berth to substantial penalties.

How To Deal With Unfiled Tax Debt

Revenue collected through taxes including payroll tax are spent on funding programs like; health care, social security, worker’s compensation, unemployment compensation and at times to enhance local transport that carries many workers to and from work.

When you have to take care of IRS tax debts, it’s extreme important to keep in touch with your IRS officials – never avert or conceal from them. Most IRS fees include a compounded rate of interest of 14% this can turn a company turtle in a very short time dealing with IRS company tax debt it overriding.

How a Seasoned Cambridge Tax Expert Can Help You

Being in an IRS business debt situation is serious. You may have time on your own side as the IRS is slow to start processing your account, but when they gain momentum things get worse for you. Yet, you aren’t helpless. There are processes you may be eligible for that a Massachusetts professional can use his good offices with the IRS to help you over come your business debts.

Amongst others, you are in need of a professional’s help for those who haven’t heard of an Offer in Compromise, Tax Lien Interval, Uncollectible Status and Insolvency. Waste no more time, touch base with us today to get out of business tax debt and save your company from close.

Say good-bye for good to your IRS back tax returns using a qualified Cambridge law firm

Have you been struggling for several years with your back tax debts, and are eventually fed up with dealing with the IRS by yourself?

Have they began sending letters and notices to your residence or company, demanding you pay interest costs and extra penalties for the amount you owe?

If so, the best thing you can do is hire a reputable and experienced tax law firm to be by your side every step of the way. The great news is, our Cambridge firm is the right candidate for the job, with an A+ company standing with the BBB, tens of thousands of satisfied clients all over the country (notably in lovely Massachusetts), and our own team of tax lawyers, CPAs and federally enrolled representatives, all prepared to work on your own case today.

The Internal Revenue Service is the largest collection agency on earth, with a large number of billions and revenue officers of dollars set aside to pursue great, hard working individuals like you for the money you owe. You shouldn’t have to confront them by yourself. We don’t get bullied about like ordinary citizens do, and can use our private contacts to negotiate the settlement that you need.

Using experienced Cambridge legal counsel on your own tax problems is like having a specialist plumber come and fix your massively leaking water main. Certainly you could likely eventually determine how exactly to fix it by yourself, but by the time you do, your home is most likely permanently damaged from leaking, and will cost a lot more than just hiring the pro in the very first place.

So do yourself, your family and your future a and let our Cambridge law firm help you with your back tax problems at once. Our team of experts is standing by, prepared to help you today!

In the event you have had a garnishment put on your own salary, our Massachusetts team can have it removed fast.

What is a Garnish of Wages?

IRS wage garnishment denotes the withholding or deduction of Massachusetts wages from an employee’s salary or damages emanating from cases of unpaid IRS taxes. In the event you owe the Internal Revenue Service back taxes and do not react to their phone calls or payment notices then chances are that you may be subjected to an IRS wage garnishment. In other quarters, it’s also known as wage attachment or a wage levy.

The garnishment procedure is generally quite extended, first the IRS discovers how much you really owe them in back taxes, after this has been done, they will send you several payment request notices in the email as well as more than a single phone call with relation to the debt in question. You generally have thirty (30) days to get in touch with IRS with regards to this notice before they proceed and forwarding the notice to your Cambridge employer. Once this notice has been sent to the Cambridge employer, you have an additional fourteen (14) days to make a reply before garnishment of wages begins. The employer usually has at least one pay period after receiving a notice of levy before they may be required to send the funds.

How Much Can the IRS Garnish from My Paychecks?

IRS garnishment rules generally allow the IRS garnish or to deduct more or 70% of an employee’s wages; this is mainly done with the aim of convincing his representative or the employee to touch base with IRS to settle the debt.

Wage garnishments are usually one of the very aggressive and harsh tax collection mechanics and one should never take them lightly, as a matter of fact, they would rather work out tax issues differently and just sanction this levy when they believe they have ran out of viable options. Even though paying off the taxes you owe the IRS is the easiest way out of such as situation, this really is usually not possible due to a wide array of reasons. First and foremost, you may not have the entire sum or the tax liability may belong to someone else or your ex spouse, you’ll be required to establish this however.

What should I do next about wage garnishment?

Do so pretty fast and you thus have to discuss any payment arrangements with the Inland Revenue Service. In this respect, it’s imperative that you get in touch with an expert who’ll help you quit or end the garnishment and to easily get a wage garnishment release. We’re a Cambridge BBB A+ rated tax firm using a team of exceptionally qualified tax attorneys with a long record of satisfied clients and years of expertise to establish this. Get in touch with us and we guarantee to get back to you within the shortest time possible, generally within one working day or less. We guarantee to help you achieve an amicable understanding together with the Internal Revenue Service(IRS) and get you a wage garnishment release.

Ultimately put a stop to the letters and notices that the IRS has been sending to you, and let our Cambridge team help.

IRS Letters and Notices are sent to individuals in Cambridge who have not filed their tax returns or have not paid all of their tax obligation. The IRS is to blame for collecting taxes due from citizens to make sure that the Federal Government has the funds to run its business. The Internal Revenue Service assumes that citizens who neglect to pay their taxes and who are delinquent in filing their tax returns are ignoring the reason why taxes are important. The Internal Revenue Service also supposes that citizens don’t have a good reason for not fulfilling their tax obligations. Competitive pursuit of these taxpayers is the reason IRS letters and notices are sent. Those who have filed their tax returns but have not paid all of the taxes that are due, will also get IRS letters and notices. For do speedy collection activity, delinquent taxpayers are on the IRS radar. Taxpayers should recall that the IRS will not have to begin any court action to levy wages, bank accounts and property. Pension income can be attached.

Fees are prolific now. In 1988, there were only 17 penalties that the IRS could impose, but now the distinct of penalties is 10 times that amount. The Internal Revenue Service also has over 75 distinct letters and notices it can send to individual taxpayers. Some of these can definitely become serious difficulties for the citizen.

Examples of Notices

Under-Reported Tax Debts

A notice that asserts their income has been under reported by a citizen in Cambridge is a serious question. Frequently, this may be reconciled easily, but the citizen will be assessed interest plus a fee if the IRS claim is valid. Then the taxpayer could be accused of filing a fraudulent return, whether this notice spans more than one year of tax filings. The penalties as well as the interest will amount to an impossible sum of money no matter the perceived purpose.

Property Garnishing

A notice that threatens to attach property, bank account or a citizen’s wages is also serious. The IRS will send a letter warning of the impending action, and this letter will stipulate an amount of time the taxpayer has to resolve the delinquency. This notice follows letters that have been sent to the citizen in an attempt to resolve the delinquency before it attains the collection activity.

Property Lien

A notice stating that the IRS has filed a lien on the citizen’s property also follows letters of intent to take this actions. The notice will contain the amount of the lien and the governmental bureau where it was recorded. This lien will avoid the citizen from selling the property until the lien is satisfied, or the lien amount will be deducted from the profits of a deal. The Internal Revenue Service can also drive the sale of the property to acquire fulfillment of the lien. A notice will be issued if a sale is planned.

What to do because of a IRS letter

The taxpayer should never discount IRS letters and notices. Rather, they need to immediately seek help with these possible dangers to their financial protection. The truth is, if a taxpayer who considers they may receive letters and notices from the IRS can contact us so we can stop these from being sent. Contacting our BBB A+ Cambridge law firm is even more significant if a letter or notice has been received. We have many years of successful experience in working with the IRS and state of Massachusetts to resolve taxpayer problems.

Other Cities Around Cambridge We Serve

| Address | Cambridge Instant Tax Attorney24 Thorndike St, Cambridge, MA 02141 |

|---|---|

| Phone | (617) 500-3822 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Cambridge We Serve | Abington, Accord, Acton, Allston, Andover, Arlington, Arlington Heights, Ashland, Attleboro Falls, Auburndale, Avon, Ayer, Babson Park, Bedford, Bellingham, Belmont, Berlin, Beverly, Billerica, Bolton, Boston, Boxborough, Boxford, Braintree, Brant Rock, Bridgewater, Brighton, Brockton, Brookline, Brookline Village, Bryantville, Burlington, Byfield, Cambridge, Canton, Carlisle, Charlestown, Chelmsford, Chelsea, Chestnut Hill, Cohasset, Concord, Danvers, Dedham, Dover, Dracut, Dunstable, East Boston, East Bridgewater, East Mansfield, East Walpole, Easton, Elmwood, Essex, Everett, Fayville, Foxboro, Framingham, Franklin, Georgetown, Gloucester, Green Harbor, Greenbush, Groveland, Halifax, Hamilton, Hanover, Hanscom Afb, Hanson, Harvard, Hathorne, Haverhill, Hingham, Holbrook, Holliston, Hopedale, Hopkinton, Hudson, Hull, Humarock, Hyde Park, Ipswich, Jamaica Plain, Lawrence, Lexington, Lincoln, Littleton, Lowell, Lynn, Lynnfield, Malden, Manchester, Mansfield, Marblehead, Marlborough, Marshfield, Marshfield Hills, Mattapan, Maynard, Medfield, Medford, Medway, Melrose, Methuen, Middleton, Milford, Millis, Milton, Milton Village, Minot, Monponsett, Nahant, Natick, Needham, Needham Heights, New Town, Newton, Newton Center, Newton Highlands, Newton Lower Falls, Newton Upper Falls, Newtonville, Nonantum, Norfolk, North Andover, North Attleboro, North Billerica, North Chelmsford, North Easton, North Marshfield, North Pembroke, North Reading, North Scituate, North Waltham, Northborough, Norton, Norwell, Norwood, Nutting Lake, Ocean Bluff, Peabody, Pembroke, Pinehurst, Plainville, Prides Crossing, Quincy, Randolph, Raynham, Reading, Readville, Revere, Rockland, Roslindale, Rowley, Salem, Saugus, Scituate, Sharon, Sheldonville, Sherborn, Somerville, South Easton, South Hamilton, South Walpole, Southborough, Still River, Stoneham, Stoughton, Stow, Sudbury, Swampscott, Tewksbury, Topsfield, Tyngsboro, Village Of Nagog Woods, Waban, Wakefield, Walpole, Waltham, Watertown, Waverley, Wayland, Wellesley, Wellesley Hills, Wenham, West Boxford, West Bridgewater, West Medford, West Newton, West Roxbury, Westborough, Westford, Weston, Westwood, Weymouth, Whitman, Wilmington, Winchester, Winthrop, Woburn, Woodville, Wrentham |

| City Website | Cambridge Website |

| Wikipedia | Cambridge Wikipedia Page |