Do you qualify to avoid paying up to 90% of your tax debt?

Find out within 15 minutes on the phone from our BBB A+ rated experts

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Worcester, and All of Massachusetts

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Our expert law firm is standing by, ready to help you today

Highly Experienced Worcester Tax Lawyer

One of many main problems that most Worcester citizens run into in terms of IRS back taxes is feeling overwhelmed and stressed about the money that they owe. With the IRS taking away property, cash and assets, and even sending threatening letters and notices, revenue officers, it may be an extremely frightening experience.

We believe that no one should need to go up against the IRS alone anymore.

It’s simply not fair what they get regular tax payers through, and we believe they must not get away with it.

That means you do not pay a penny for the total use of our seasoned team for a complete week.

30 Day Money Back Guarantee that is on the very top of our no questions asked. If you aren’t satisfied for any reason with our service, simply let us know within 30 days, and you will get all of your cash back.

So what are you waiting for? The longer that you put it off and wait, the more fees and interest charges the IRS will tack on to the amount that you simply owe. Take action and call our Worcester team a call today to get started!

Give our office a call today!

Has the IRS been sending you notices and letters? Desire that to quit immediately? We can help.

IRS Letters and Notices are sent to those who have not paid all of their tax obligation or have not filed their tax returns. The Internal Revenue Service is responsible for collecting taxes due from citizens to make sure that the Federal Government has the money to conduct its business. The IRS assumes that taxpayers who are delinquent in filing their tax returns and who fail to pay their taxes are ignoring the reason taxes are significant. The IRS also assumes that citizens do not have a great rationale for not fulfilling their tax obligations. Competitive pursuit of these taxpayers is the reason why IRS letters and notices are sent. For executing speedy collection action, delinquent citizens are on the Internal Revenue Service radar. Citizens should recall that the IRS does not have to commence any court action to levy wages, bank accounts and property. Pension income can be attached.

Fees are prolific. Now the different of fees is 10 times that number, although in 1988, there were only 17 penalties the IRS could levy. The Internal Revenue Service also has over 75 different letters and notices it can send to individual citizens. Some of these can definitely become serious difficulties for the citizen.

Some Examples of Notices

Low-Reported Tax Debts

A notice that maintains a taxpayer has under reported their income is a serious matter. Frequently, this may be accommodated readily, in the event the IRS claim is valid, but the citizen will be evaluated a penalty plus interest. Then the citizen could be accused of filing a fraudulent return, whether this notice spans more than one year of tax filings. The interest and the fees will amount to an unimaginable amount of money irrespective of the perceived purpose.

Property Garnishes

A notice that threatens to attach a citizen’s wages, bank account or property is also serious. The IRS will send a letter warning of the forthcoming action, and this letter will stipulate a period of time that the taxpayer has to resolve the delinquency. Letters which have been sent to the taxpayer in an attempt to resolve the delinquency before it reaches the collection activity are followed by this notice.

Home Lien

A notice saying that the IRS has filed a lien on the taxpayer’s property also follows this action to be taken by letters of intent. The notice will contain the total amount of the lien and also the governmental bureau where it was recorded. The IRS can also drive the selling of the property to obtain satisfaction of the lien. A notice will be issued if a sale is planned.

What you should do because of a letter

The citizen should never discount IRS letters and notices. Rather, they ought to immediately seek help with these potential dangers to their financial protection. Contacting our BBB A+ Worcester law firm is even more important if notice or a letter has been received. We’ve got many years of successful experience in working with the Internal Revenue Service and state of Massachusetts to resolve taxpayer problems.

You could immediately cut your tax debt in half by using our penalty abatement program.

Once the IRS strike on you or your firm with a tax bill, it normally appends penalties and interest charges. Some penalties, like late payments, they’re included automatically by IRS computers.

The Internal Revenue Service supposes you acknowledge them should you not complain once penalties are inflicted. Fortunately, the IRS can confiscate a fee just as straightforward as it contained one. The key to the realm of the tax fee relief is showing a reasonable reason behind your letdown to mind with tax law.

The quantity of tax code fines that are different is staggering. Here are a few of the penalties that IRS will tack on to the debts of people who have not filed their tax debts that are overdue.

Incorrectness:

The IRS will impose a 20 % penalty on you if you considerably minimized your taxes or were unreasonably negligent. This precision-connected fine is applied the IRS learns it and when you are unable to establish a tax write-off in a review, or you did not submit all your income.

Civil deceit:

In case the IRS discovers that you weren’t reported your income with a deceitful intention, a penalty 75% may be attached.

Delayed Payment:

This late payment fine is tacked on by the IRS computer automatically whenever you file a tax return devoid of paying the outstanding balance, or when you make a delayed payment. Fines for failing to make payroll tax deposits punctually are much elevated.

Not Filing on time:

If you didn’t file your return punctually, the IRS can fine you an additional 5% per month on any outstanding balance. However, this punishment could be employed just for the initial five months after the due date of the return, equivalent to a 25% higher cost. When there isn’t any outstanding balance, the IRS can nevertheless impose lesser penalties.

When you know the way and also the reason the IRS hit you with fines, you can need that they removed or be abridged. The IRS name for this procedure is called an abatement. About one third of all tax fees are finally abated, and even it’s going to be more if you understand the approaches to contest them.

Simply advising the IRS that you really do not like a penalty, or cannot actually afford to compensate it, will not work. You need to demonstrate sensible cause, which means a supplication that is good. Based on the IRS, any sound cause advanced as the reason for postponement by a taxpayer in paying tax when owed will be carefully analyzed, filing a return, or making deposits.

Ways to request for an IRS penalty and interest abatement

Enclose these documents with your written request.

- Letter from a registered medical practitioner, describing your state that prevented you from filing your tax return on time.

- Death certificate substantiating the bereavement of your blood or close connections.

- A comprehensive report from the fire department if your property is damaged because of fire.

What to Do Next

Should you have been imposed fees by the Internal Revenue Service, there are some effective and easy methods to get your tax fines or interest condensed or eliminated totally. We’ve been for a long time in the industry and we are dedicated to offer our customers a professional IRS penalty and interest abatement service lawfully. Contact us today to resolve your tax problems all and the related penalties levied by the IRS on you or in your Worcester company.

If you have had a garnishment put on your own salary, our Massachusetts team can have it removed fast.

What is a Wage Garnishment?

Should you owe the IRS back taxes and do not respond to payment notices or their phone calls chances are that you may be subjected to an IRS wage garnishment. In other quarters, it’s also called wage attachment or a wage levy. It’s worth noting that a court order is generally not required and other state and national laws pertaining to the whole amount of exempted from garnishment does provide several exceptions for the wage levies.

The garnishment procedure is usually quite extended, first the IRS determines how much you owe them in back taxes, after this has been done, they’ll send you several payment request notices in the mail in addition to more than one phone call with regards to the debt in question. You usually have thirty (30) days to touch base with IRS with regards to this notice till they go ahead and forwarding the notice to your Worcester company. Once this notice was sent to the Worcester employer, you’ve got a further fourteen (14) days to make a response before garnishment of wages begins. The employer generally has at least one pay period before they are required to send the funds, after receiving a notice of levy.

How Much Can they Take from My Wages?

IRS garnishment rules commonly permit the Internal Revenue Service garnish or to deduct 70% or more of an employee’s wages; this is mostly done with the aim of convincing his representative or the worker to touch base with IRS to settle the debt. It is also worth mentioning that the income which are exempted from garnishment do depend on the tax filing status of the garnishee (filing jointly, married or single) and numerous listed dependents on the tax return.

Wage garnishments are generally one of the most competitive and severe tax collection mechanisms and one should never take them lightly, as a matter of fact, they’d rather resolve tax problems otherwise and just sanction this levy when they believe they have ran out of feasible alternatives. This really is generally not possible because of wide selection of motives, even though paying off the taxes you owe the IRS is the simplest way out of such as situation. First and foremost, you might not have the whole sum or the tax liability may belong to your ex spouse or somebody else, you may be required to show this however.

What should I do because of a wage garnishment?

You therefore have to discuss any payment arrangements with the Internal Revenue Service and do so pretty quick. In this regard, it’s imperative that you simply get in touch with an expert who will help you stop or end the garnishment and to easily obtain a wage garnishment release. We are a Worcester BBB A+ rated tax company with a team of highly competent tax lawyers with years of expertise along with a long record of satisfied clients to demonstrate this. Get in touch with us and we promise to get back to you within the least time possible, generally within one working day or less. We promise to assist you reach an amicable agreement together with the Internal Revenue Service(IRS) and get you a wage garnishment release.

The very best way of eventually getting out of debt would be to use the experience and know-how of a reputable law firm serving Worcester

Have you been fighting with your back tax debts for several years, and are eventually fed up with dealing with the IRS on your own?

Have they started sending notices and letters to company or your home, demanding you pay extra fees and interest costs for the sum you owe?

If so, the best thing yo ulna do is hire a tax law firm that is experienced and reputable to be by your side every step of the way. The good news is, our Worcester company is the perfect candidate for the occupation, with an A+ business rating with all the BBB, thousands of satisfied clients all around the nation (notably in exquisite Massachusetts), and our own team of tax attorneys, CPAs and federally enrolled representatives, all ready to work on your own case today.

The IRS is the largest collection agency on earth, with a large number of billions and revenue officers of dollars set aside to chase great, hard working people like you for the money you owe. You shouldn’t have to face them by yourself. We don’t get bullied around like normal citizens do, and can use our private contacts to negotiate the resolution that you need.

Using experienced Worcester legal counsel in your tax problems is similar to having a specialist plumber come and mend your massively leaking water main. Sure you could likely finally learn how exactly to repair it by yourself, but by the time you do, your home is most likely permanently damaged from leaking, and certainly will cost much more than simply hiring the expert in the first place.

Our crew of specialists is standing by, prepared to help you!

A 15 minute consultation with our Worcester team can help potentially save you tens of thousands of dollars

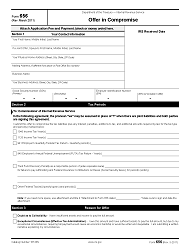

What is an OIC program

The customer faced with serious tax issues by paying or rather bailing them out up to less compared to the sum owed is helped by the Internal Revenue Service. Nevertheless, not all distressed taxpayers qualify for IRS Offer in Compromise Deal. This is completely because qualification relies on several factors after appraisal of the customer was carried out. The IRS Offer in Compromise Arrangement plays an instrumental role in helping taxpayers with distressed fiscal challenges solve their tax problems. This implies that the IRS functions as the intermediary that helps their tax debt is paid by the citizen in the manner that is most convenient and flexible. The main interest and point of focus is the compromise that totally suits the needs of both the citizen and also the Internal Revenue Service (IRS).It’s wise to note that the citizen must make a valid and proper offer vis-a-vis what the IRS considers their sincere and exact possibility to pay.

How Hard is it to Qualify for an OIC agreement?

Filling the applications doesn’t guarantee the Worcester citizen an immediate qualification. The IRS begins evaluation procedure and the overall appraisal that may leave you incapable of paying your taxes. The applications must be filled with utmost correctness saying definitely reasons for your inability to pay tax. These applications are then supported with other relevant documents that will be utilized by the IRS to find out the qualifications of the citizen for an Offer in Compromise Agreement. Nevertheless, there are a few of the few qualifications process that must be met entirely be the citizen. All these are the three basic tenets of qualification that every taxpayer must meet in order to be considered.

What to Do now

Thus if you are truly one of these citizens in need of care and guidance when it comes to IRS, then BBB A+ rated tax law business serving Worcester is there for you to help negotiate an IRS Offer in Compromise deal. This really is an incredible law firm that’ll function as a yard stick for all those who need appropriate help in negotiating for an IRS offer in compromise deal. Do not hesitate to contact them because they’ve a great security standing and a strong portfolio. They’ve a team of competent and dynamic professionals who are constantly on hand to help you. Try them now and expertise help like never before. It is simply the finest when it comes to negotiation of an IRS offer in compromise agreement.

Other Cities Around Worcester We Serve

| Address | Worcester Instant Tax Attorney339 Main St, Worcester, MA 01608 |

|---|---|

| Phone | (617) 500-3822 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Worcester We Serve | Acton, Ashburnham, Ashby, Ashland, Auburn, Auburndale, Ayer, Babson Park, Baldwinville, Barre, Bellingham, Berlin, Blackstone, Bolton, Bondsville, Boxborough, Boylston, Brimfield, Brookfield, Carlisle, Charlton, Charlton City, Charlton Depot, Cherry Valley, Clinton, Concord, Douglas, Dover, Dudley, East Brookfield, East Princeton, East Templeton, Fayville, Fiskdale, Fitchburg, Framingham, Franklin, Gardner, Gilbertville, Grafton, Groton, Hardwick, Harvard, Holden, Holland, Holliston, Hopedale, Hopkinton, Hubbardston, Hudson, Jefferson, Lancaster, Leicester, Leominster, Lincoln, Linwood, Littleton, Lunenburg, Manchaug, Marlborough, Maynard, Medfield, Medway, Mendon, Milford, Millbury, Millis, Millville, Monson, Natick, Needham, Needham Heights, New Braintree, Newton Lower Falls, Norfolk, North Brookfield, North Grafton, North Oxford, North Uxbridge, Northborough, Northbridge, Oakham, Oxford, Palmer, Paxton, Petersham, Plainville, Princeton, Rochdale, Rutland, Sheldonville, Sherborn, Shirley, Shrewsbury, South Barre, South Grafton, South Lancaster, South Walpole, Southborough, Southbridge, Spencer, Sterling, Still River, Stow, Sturbridge, Sudbury, Sutton, Templeton, Thorndike, Three Rivers, Townsend, Upton, Uxbridge, Village Of Nagog Woods, Waban, Wales, Waltham, Ware, Warren, Wayland, Webster, Wellesley, Wellesley Hills, West Boylston, West Brookfield, West Groton, West Millbury, West Townsend, West Warren, Westborough, Westford, Westminster, Weston, Westwood, Wheelwright, Whitinsville, Woodville, Worcester, Wrentham |

| City Website | Worcester Website |

| Wikipedia | Worcester Wikipedia Page |