Boston Residents can Potentially Qualify to Save Up to 90% on their Tax Debts

Find out if you do from our BBB A+ Rated Tax Professoinals

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Boston, and All of Massachusetts

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Our top-rated team can help you save a ton on your back tax debt

Highly Experienced Boston Tax Lawyer

One of the worst things you can do with IRS back tax debt is continue to neglect it for a long time at a time. The IRS wants to add to the quantity you owe, and will stop at nothing to collect that money on interest costs and additional penalties.

They are the greatest collection agency on the planet, and we steadfastly believe that no one should have to face them by themselves again.

For most of US, having a massive government agency always harassing them with revenue officers and letters, notices is a horrible thought.

That’s why our Boston team is here to assist you. You will have someone in your corner to help negotiate for you, and no longer need to manage the IRS by yourself.

With only 15 minutes on the telephone with our pros, you’ll know what to do next, and exactly what you may qualify for.

Give our office a call today!

Avoid being conned by a Massachusetts tax relief firm, and let our BBB A Rated team help you

Many people are law abiding Boston citizens and they fear the risks of IRS action. Seeing this as an excellent opportunity, plenty of tax resolution companies out there set out like vultures circling on these preys that were weakened. These companies commit even and consumer fraud theft and tempt innocent individuals into their scams! There are various ways in which they deceive people of their hard earned money: by charging upfront nonrefundable payments without providing any guarantees, by misrepresenting prospective outcomes, by posing as a service provider and selling the sensitive information of the customers to other service providers, by outright larceny from customers and so on. Thus, you should exercise care when you’re attempting to locate a tax resolution firm for yourself.

What Tax Relief Scams can do

Not all Massachusetts tax relief companies who guarantee to negotiate together with the IRS for you are trustworthy. Consequently, averting IRS tax aid scams is vitally important because there are so many deceptive companies out there. It is not impossible to prevent being taken advantage of, all you have to do would be to train yourself in this respect and to follow a couple of hints that are useful! First things first, never pay in full upfront whether the tax resolution company asks for it in the beginning or in an obscure manner at some point of time. An authentic tax resolution company will consistently folow a mutually acceptable financial arrangement wherein the payments could be made on a weekly, bi-weekly or monthly basis.

Second, it is advisable to be quite careful when you’re choosing a special tax resolution firm to work with. Chances are the business is fallacious if they assure you the desired outcomes or state that you just qualify for any IRS plan without even going through a complete financial analysis of your current situation then. Thus, do not fall for their sugar-coated promises and hunt for other authentic companies instead.

How to find out about a tax relief firm

The web is a storehouse of info, but you have to be cautious about using such advice. Don’t just hire any firm that is haphazard with great ads or promotional campaigns for handling your tax associated issues. Consequently, doing your homework and investing time in research is certainly a sensible move here.

A website with a good evaluation on BBB is undoubtedly one which you can put your trust in. We’re a BBB A+ rated Boston business, we help individuals by alleviating their IRS back tax debts. Our tax solutions are sensible, to be able to make sure that all your tax debts are removed, we do not merely negotiate on your own behalf together with the IRS, but instead produce a practical strategy. We do all the hard work for you while you concentrate on different significant facets of your life. Due to our vast experience and expertise in the field, you can rest assured that your tax problems would be resolved immediately and effectively when you turn for help to us.

In the event you have had a garnishment placed in your wages, our Massachusetts team can have it removed quickly.

What is a Garnishment?

IRS wage garnishment denotes the withholding or deduction of Massachusetts wages from an employee’s salary or damages emanating from instances of unpaid IRS taxes. Should you owe the IRS back taxes and don’t respond to payment notices or their phone calls then chances are that you may be subjected to an IRS wage garnishment. In other quarters, it’s also known as wage attachment or a wage levy. It’s worth noting that a court order is generally not required and other state and national laws pertaining to the overall amount of exempted from garnishment does provide several exceptions for the wage levies.

The garnishment procedure is usually fairly extended, first the IRS determines how much you owe them in back taxes, once this has been done, they will send you several payment request notices in the email in addition to more than just one phone call with regards to the debt in question. You normally have thirty (30) days to get in touch with IRS with regards to this notice before they go ahead and forwarding the notice to your Boston company. After this notice was sent to the Boston company, you have a further fourteen (14) days to make a reply before garnishment of wages begins. The company typically has at least one pay period before they can be expected to send the money after receiving a notice of levy.

How Much Can the IRS Take from My Paychecks?

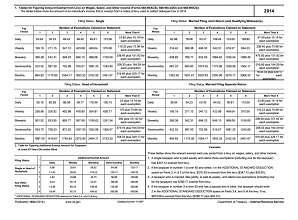

IRS garnishment rules typically permit the Internal Revenue Service to deduct or garnish 70% or more of an employee’s wages; this is mostly done with the intention of convincing his representative or the employee to touch base with IRS to settle the debt. Additionally it is worth saying that the income which are exempted from garnishment do depend on the tax filing status of the garnishee (filing jointly, married or single) and numerous listed dependents on the tax return.

Wage garnishments are typically one of the most aggressive and severe tax collection mechanisms and one should never take them lightly, as a matter of fact, they would rather resolve tax issues otherwise and just sanction this levy when they believe they have ran out of viable options. This really is typically not possible because of wide array of reasons, even though paying off the taxes you owe the IRS is the easiest way out of such as situation. First and foremost, you may not possess the tax liability or the entire amount may belong to your ex spouse or somebody else, you will be asked to demonstrate this though.

What should I do because of a wage garnishment?

Do fairly fast and you therefore have to discuss any payment arrangements with the Inland Revenue Service. In this regard, it’s imperative that you just get in touch with an expert who will enable you to easily get a wage garnishment discharge and cease or end the garnishment. We’re a Boston BBB A+ rated tax company using a team of highly qualified tax lawyers with a long list of satisfied clients along with years of experience to establish this. Touch base with us and we guarantee to get back to you within the least time possible, normally within one working day or less.

Let our Massachusetts team negotiate a payment plan for you, so you are able to repay your debt over time

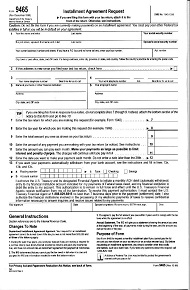

So long as the taxpayer pays their tax debt in full under this Arrangement, they could reduce or get rid of the payment of fees and interest and prevent the payment of the fee that is connected with creating the Agreement. Creating an IRS Installment Agreement requires that all required tax returns are filed prior to applying for the Agreement. The taxpayer cannot have any unreported income. If more than $50,00 in tax debts are owed, then the taxpayer may apply for a longer period to pay the debt. In some cases, a taxpayer may ask for a longer interval than 72 months to pay a tax debt of $50,000 or less. back

Good Things about an Installment Agreement

The agreement will bring about certain significant gains for the citizen. Enforced group activity WOn’t be taken while an arrangement is in effect. There’ll be more financial freedom when the citizen can count on paying a set payment every month rather than having to worry about getting lump sum amounts on the tax debt. The citizen will remove continuing IRS fees and interest. The Internal Revenue Service will assist the taxpayer keep the arrangement in force if the taxpayer defaults on a payment providing the IRS is notified instantly.

Obligations of the Installment Agreement

Some obligations have the Installment Agreement. The minimum monthly payment should be made when due. The income of the incomes of citizens that were joint or an individual taxpayer should be disclosed when putting in an application for an Installment Agreement. Sometimes, a financial statement must be provided. All future returns must be submitted when due and all of the taxes must be paid when due. This way of making monthly payments enable the citizen to request the lien notice be removed. However, the lien can be reinstated if the taxpayer defaults on the Installment Agreement.

The citizen and the IRS can negotiate an Installment Agreement. However, specific advice should be supplied and any info might be subject to confirmation. For taxpayers a financial statement will be required.

How to Prepare to Apply for an Installment Agreement

There are some precautions that must be considered while citizens can submit an application for an IRS Installment Agreement. Though the IRS tries to make applying for an Installment Agreement a procedure that is relatively simple, there are some circumstance which can make this a challenging endeavor. It is crucial to get it right the first time that the application is made since many problems can be eliminated by an Installment Agreement with the Internal Revenue Service.

We’re the BBB A+ rated law firm serving all of Boston and Massachusetts, which may provide skilled support to you. Our many years of experience working with the Internal Revenue Service on behalf of Boston citizens that have difficulties paying their tax debt qualifies us to ensure approval of your application for an Installment Agreement.

Say goodbye for good to your IRS back tax returns using a competent Boston law firm

Have you been fighting for a number of years with your back tax debts, and are eventually fed up with dealing with the IRS by yourself?

Have they began sending notices and letters to company or your home, demanding you pay additional penalties and interest costs for the sum you owe?

If so, the best thing you can do is hire a reputable and experienced tax law business to be by your side each step of the way. The great news is, our Boston company is an ideal candidate for the occupation, with an A+ business rating with the BBB, tens of thousands of satisfied customers around the nation (particularly in lovely Massachusetts), and our own team of tax attorneys, CPAs and federally enrolled agents, all ready to work in your case today.

The IRS is the biggest collection agency in the world, with a huge number of billions and revenue officers of dollars set aside to pursue good, hard working people like you for the money you owe. The single thing they care about is getting the money they are owed. You should not have to face them by yourself. We don’t get intimidated about like normal citizens can use our private contacts to negotiate the settlement that you need, and do.

Using seasoned Boston legal counsel on your own tax issues is like having an expert plumber come and fix your massively leaking water main.

So do your future, your family and yourself a a favor now, and let our Boston law firm help you with your back tax issues at once. Our crew of specialists is standing by, prepared to help you today!

A 15 minute consultation with our Boston team can help possibly save you tons of dollars

What is it

The IRS helps the customer faced with serious tax issues bailing them out up to less in relation to the sum owed or instead by paying. However, not all distressed citizens qualify for IRS Offer in Compromise Deal. This is solely after assessment of the customer has been carried out, because qualification relies on several variables. The IRS Offer in Compromise Deal plays an instrumental role in aiding citizens with distressed financial challenges solve their tax problems. This means that the IRS functions as the intermediary which helps the citizen pay their tax debt in the handiest and flexible fashion. The primary interest and point of focus is the compromise that totally suits the needs of both the citizen as well as the Internal Revenue Service (IRS).It’s a good idea to note the citizen must make a valid and appropriate offer vis-a-vis what the IRS considers their true and precise potential to pay.

What Does it Take to Qualify?

Filling the applications does not guarantee the Boston taxpayer an immediate qualification. Instead, the Internal Revenue Service begins the total appraisal and evaluation procedure that could render you incapable of settling your taxes. The applications must be filled with utmost precision stating clearly reasons for your inability to pay tax. These applications are then supported with other applicable records that’ll be utilized by the IRS to find out the qualification of the taxpayer for an Offer in Compromise Agreement. Nonetheless, there are a few of the few qualifications procedure that must be met totally be the taxpayer. Some of these qualifications include but not restricted to ensuring that the citizen files all the tax returns that they are legally bound to file, make and present each of the estimated amount of tax payments for the current year and finally the citizen is designed to make deposits for all the federal tax for the current quarter especially for citizens who run businesses with workers. All these are the three basic tenets of qualification that each citizen must meet in order to be considered.

What to Do now

Therefore if you are just one of those citizens in need of guidance and care when it comes to IRS our BBB A+ rated tax law business helping Massachusetts is there for you to help negotiating an IRS Offer in Compromise agreement. This is an amazing law firm that may function as a yard stick for people who demand help that is appropriate in negotiating for an IRS offer in compromise agreement. Do not hesitate to contact them because they’ve a great safety reputation and a strong portfolio. They have a team of dynamic and capable professionals that are constantly on hand to help you. Try them now and experience help like never before. It is simply the greatest when it comes to negotiation of an IRS offer in compromise agreement.

Other Cities Around Boston We Serve

| Address | Boston Instant Tax Attorney1 Beacon St, Boston, MA 02108 |

|---|---|

| Phone | (617) 500-3822 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Boston We Serve | Abington, Accord, Acton, Allston, Andover, Arlington, Arlington Heights, Ashland, Attleboro Falls, Auburndale, Avon, Babson Park, Bedford, Bellingham, Belmont, Berlin, Beverly, Billerica, Bolton, Boston, Boxborough, Boxford, Braintree, Brant Rock, Bridgewater, Brighton, Brockton, Brookline, Brookline Village, Bryantville, Burlington, Byfield, Cambridge, Canton, Carlisle, Charlestown, Chartley, Chelmsford, Chelsea, Chestnut Hill, Cohasset, Concord, Danvers, Dedham, Dover, Dracut, Duxbury, East Boston, East Bridgewater, East Mansfield, East Walpole, Easton, Elmwood, Essex, Everett, Fayville, Foxboro, Framingham, Franklin, Georgetown, Gloucester, Green Harbor, Greenbush, Groveland, Halifax, Hamilton, Hanover, Hanscom Afb, Hanson, Harvard, Hathorne, Hingham, Holbrook, Holliston, Hopedale, Hopkinton, Hudson, Hull, Humarock, Hyde Park, Ipswich, Jamaica Plain, Lawrence, Lexington, Lincoln, Littleton, Lowell, Lynn, Lynnfield, Malden, Manchester, Mansfield, Marblehead, Marlborough, Marshfield, Marshfield Hills, Mattapan, Maynard, Medfield, Medford, Medway, Melrose, Methuen, Middleton, Milford, Millis, Milton, Milton Village, Minot, Monponsett, Nahant, Natick, Needham, Needham Heights, New Town, Newton, Newton Center, Newton Highlands, Newton Lower Falls, Newton Upper Falls, Newtonville, Nonantum, Norfolk, North Andover, North Attleboro, North Billerica, North Chelmsford, North Easton, North Marshfield, North Pembroke, North Reading, North Scituate, North Waltham, Northborough, Norton, Norwell, Norwood, Nutting Lake, Ocean Bluff, Peabody, Pembroke, Pinehurst, Plainville, Prides Crossing, Quincy, Randolph, Raynham, Raynham Center, Reading, Readville, Revere, Rockland, Roslindale, Rowley, Salem, Saugus, Scituate, Sharon, Sheldonville, Sherborn, Somerville, South Easton, South Hamilton, South Walpole, Southborough, Still River, Stoneham, Stoughton, Stow, Sudbury, Swampscott, Tewksbury, Topsfield, Tyngsboro, Village Of Nagog Woods, Waban, Wakefield, Walpole, Waltham, Watertown, Waverley, Wayland, Wellesley, Wellesley Hills, Wenham, West Boxford, West Bridgewater, West Medford, West Newton, West Roxbury, Westborough, Westford, Weston, Westwood, Weymouth, Whitman, Wilmington, Winchester, Winthrop, Woburn, Woodville, Wrentham |

| City Website | Boston Website |

| Wikipedia | Boston Wikipedia Page |