Some IRS programs may allow you to legally avoid paying up to 90% of what you owe

Find out if you qualify for them with a quick 15 minute phone call with our experts

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Brockton, and All of Massachusetts

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Quickly removing liens, levies and garnishments, and fighting with the IRS on your behalf

Highly Experienced Brockton Tax Lawyer

The IRS likes to add to the quantity you owe, and certainly will stop at nothing to collect that money on interest costs and additional fees.

They’re the biggest collection agency on earth, and we firmly believe that no one should have to face them by themselves.

For many people, having a gigantic government agency always harassing them with revenue officers and letters, notices is a terrible idea.

That’s why our Brockton team is here to help you. You no longer need to handle the IRS on your own, and will have someone in your corner.

With just 15 minutes on the telephone with our specialists, you’ll understand precisely what you’ll qualify for, and what to do next.

Give our office a call today!

The most effective means of finally getting out of debt is to utilize the experience and know-how of a reputable law firm serving Brockton

Have you been struggling for several years with your back tax debts, and are eventually fed up with dealing with the Internal Revenue Service by yourself?

Have they started sending notices and letters to business or your home, demanding you pay additional fees and interest charges for the amount you owe?

If so, the best thing yo ulna do is hire an experienced and reputable tax law firm to be by your side each step of the way. The good news is, our Brockton company is the ideal candidate for the job, with an A+ business rating with the BBB, thousands of satisfied clients around the country (notably in beautiful Massachusetts), and our own team of tax attorneys, CPAs and federally enrolled representatives, all prepared to work on your own case today.

The IRS is the largest collection agency in the world, with a large number of billions and revenue officers of dollars set aside to pursue great, hard working people like you for the money you owe. You should not have to face them by yourself. We don’t get intimidated about like regular citizens do, and can use our private contacts to negotiate the settlement that you need.

Using experienced Brockton legal counsel in your tax issues is like having an expert plumber come and fix your massively leaking water main. Sure you could likely finally find out how exactly to repair it by yourself, but by the time you do, your home is most likely permanently damaged from leaking, and certainly will cost a lot more than simply hiring the pro in the very first place.

Do your future, your family and yourself a favor right now, and let our Brockton law firm help you with your back tax issues right away. Our crew of specialists is standing by, ready to help you today!

In case you have had a bank levy put on accounts or your property, let our Massachusetts team remove it for you within two days.

Bank levies are charges imposed on your Brockton bank account when you’ve got outstanding tax debt. Sadly, the procedure is always rough. Usually, the institution ends up freezing all the cash that’s available in a specified account for a period of 21 days to deal with a man’s or a company’ tax obligation. During the freeze, you cannot get your cash. When the period lapses when they are unfrozen, the single possibility of getting them at this stage is. Preventing the levy allows you to access your funds for meeting other expenses.

When and Why Levies Get Applied

The IRS bank levies are applied to your account as a last resort for you to pay taxes. It happens to people in Massachusetts who receive many assessments and demands of the taxes they owe the revenue bureau. Failure leaves the IRS with no choice other than to go for your bank account. This occurs through communication between the Internal Revenue Service and your bank. In case you are unaware, you’ll find that on a certain day. It can be more than that and you get a refund after the levy period, although the sum equivalent solely influences to your tax debt. For meaning to levy along with a telling about your legal right to a hearing, a closing notice is followed by bank levies. In a nutshell, the Internal Revenue Service notifies you of the pending bank levies. When implemented, the IRS can just require cash which was in your bank on the date a levy is implemented.

How to Have Bank Levies Removed in Brockton

There’s a window of opportunity for you to utilize to get rid of bank levies from your account. Getting professional help as you take measures to safeguard your bank assets is a sensible move that you simply should take. With a professional service helping out, it will not be difficult for you to know when to take your money out of the bank. You additionally have to enter into a payment arrangement with the Internal Revenue Service to prevent future bank levies, before the bank levy occurs besides removing your funds. You can do it by getting into an installment agreement. You may also appeal and seek qualification for ‘uncollectable status’. Lastly, you can go for ‘offer in compromise’ as a method to get tax forgiveness.

They may be very complicated to execute while the solution sound easy. Have the resources to do so you must act fast, understand every part of the law and deal with related bureaucracies imposed by banks along with the IRS. The smart move would be to phone us for professional help with your IRS situation. We’ve skills and experience which have made us a number one pick for a lot of individuals. For partnered tax professional aid, contact us for additional information and help.

It is time to stop the revenue officers from harassing you and for all!

What is an IRS revenue officer?

An IRS officer or representative is an average visitor to your Massachusetts business or daily life. Obtaining a differentiation between the two is important for you to understand how to cope with each. An IRS agent has the principal role of auditing tax returns. They send notifications regarding impending audits via email. You can either go to local IRS office when you get an email from IRS representative or an agent comes over to your house or business to audit returns.

The Internal Revenue Service assigns you a revenue officer in these situation:

Inability to Collect Tax Payments

When the IRS has failed to successfully collect taxes from you using the ordinary channels like e-mails, levies, notices and telephone calls.

Un-Filed Back Tax Returns

When you neglect to pay certain kind of taxes like payroll taxes.<?p>

Huge Tax Debts

When your tax liability is substantially large, a standard amount being 25,000 dollars or more.

Recall IRS revenue officers are mandated by law to undertake measures to regain the taxes. These measures can include issue levies, confiscate and repossess property, freeze assets or wage garnishments. Expect these officers to appear at your house or area of businesses unexpected or without prior communication. In infrequent cases, the policemen might call you or send you emails summoning you to their offices. Try and collaborate with them to avoid further complicating your case and attempt to pay you over-due taxes to the widen your income can accommodate. The tax sum requires you to workout a blueprint to pay or if your case is more complicated, you will need the professional services of an attorney.

What You Should Do if you Face {a Revenue Officer|an IRS Revenue Officer

When you are not able to pay off your debt immediately, the IRS officer might request financial records and some files. Filling these forms should be done right and precisely therefore the professional services of an attorney are needed. If you fill the forms wrong whether knowingly or unknowingly, the Internal Revenue Service can use this against you and sue you for tax evasion. Hence, when you get these forms, the first thing to do would be to telephone legal counsel.

Also, a lawyer in Brockton will review your financial situation and work out the best paying plan with the IRS revenue officials. Without an attorney, you might be intimidated by the IRS policemen into consenting to a strategy that you cannot afford but which makes their job easier. In the event you are given datelines that are tight, an attorney can certainly negotiate and get you a more adaptable one. Remember, there are several choices that may be offered by the policeman. A common one in case associated with payroll delinquent will be to assess and assign you a retrieval penalty trust fund. For this to occur, an interview should be run to discover who’s the real perpetrator between a company along with an individual and having an attorney in this interview in Massachusetts is a matter of necessity.

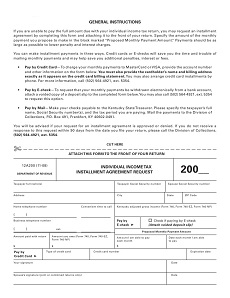

So you don't have to pay all at once, an Installment Agreement can spread out your payments over time

The IRS Installment Agreement is a way for citizens in Brockton when they can’t pay it in full with their tax return to pay their tax debt. As long as their tax debt is paid by the citizen in full under this particular Agreement, they can reduce or get rid of the payment of penalties and interest and avoid the payment of the fee that’s connected with creating the Deal. Establishing an IRS Installment Agreement requires that all required tax returns have been filed before applying for the Understanding. The citizen cannot have any unreported income. Individual citizens who owe $50,000 or less in combined individual income tax including penalties and receive can interest 72 months the amount of tax owed . If more than $50,00 in tax debts are owed, then the citizen may apply for a longer period to pay the debt. Sometimes, a taxpayer may request a longer interval than 72 months to pay a tax debt of $50,000 or less. back

Good Parts about an Payment Plan

The agreement will result in some significant advantages for the taxpayer. While an arrangement is in effect enforced set actions will never be taken. There will be more financial freedom when the taxpayer can count on paying a set payment each month rather than having to agonize about getting lump sum amounts on the tax debt. The taxpayer will eliminate interest and continuing IRS fees. The Internal Revenue Service will assist in the event the taxpayer defaults on a payment providing the IRS is notified immediately, the taxpayer keep the agreement in force.

Obligations of the Installment Agreement

Some duties include the Installment Agreement. When due, the minimum payment must be made. The income of the incomes of combined citizens or an individual citizen should be disclosed when putting in an application for an Installment Agreement. In some cases, a financial statement must be supplied. All future returns must be submitted when due and all the taxes owed with these returns should be paid when due. Taxpayers paying their tax debt under an Installment Agreement may have to authorize direct debit of their checking account. This way of making monthly payments enable the citizen to request that the lien notice be withdrawn. However, the lien can be reinstated in the event the taxpayer defaults on the Installment Agreement.

The citizen can negotiate an Installment Agreement with the Internal Revenue Service. Nevertheless, particular information must be provided and any info could be subject to affirmation. For taxpayers owing more than $50,000, a financial statement will be required.

How to Prepare to Apply for an Installment Agreement

There are a few precautions that must be considered, while taxpayers can make an application for an IRS Installment Agreement. Even though the IRS attempts to make using for an Installment Agreement a procedure that is relatively simple, there are some situation which can make this a challenging undertaking. Since an Installment Agreement can remove many issues with the IRS, it’s important to get it right the very first time the application is made.

We are the BBB A+ rated law firm serving all of Brockton and Massachusetts, that could offer you expert help. Our many years of experience working on behalf of taxpayers who have problems with the IRS qualifies us to ensure approval of your application for an Installment Agreement.

For those who have failed to pay your taxes for several years, our Brockton team can help you get back on track.

Have you forgotten to file your back tax returns for several years? We can help.

The W-2S and 1099 forms for each tax year are essential when filing your back tax returns you receive. In the event you’re eligible to deductions and credits; you will have to assemble any other supporting document that may prove your eligibility to the claim.

You should use the form to request for 1099S, W-2S which should provide support for your deductions. IRS will provide you with a transcript including the information that you need to file your tax returns.

In addition, you should file your tax returns that are back on the initial forms for that tax year. Start by searching for them in the IRS web site. Double check to make sure that you’re utilizing the instructions linked to an identical tax year you’re filling returns for once you have collected all the important documents. Tax laws are constantly changing and using the improper directions may require you to start the filing procedure once more. Eventually, they need to submit all of the forms to the IRS through the address given.

What to Do With Un-Paid Tax Returns

You must comprise as much payment as you can for those who have some additional income tax for the previous years. This fashion in which you may reduce interest costs accumulation. Unlike the tax penalties which stop to accumulate once they’re at the maximum, the monthly interests continue to collect until you’ve paid the tax. Following the IRS has received your tax returns, they will send you a notice of the exact amount you need to pay as a penalty and interest rate.

If you are unable to pay your tax returns in full, you may have to work with the IRS. Nevertheless, you should note the past due debts and taxes that are back, can reduce your federal tax refund. Treasury offset program may use any state or federal debt that is outstanding to settle.

It might use your full tax refund or component to pay some debts including unemployment compensation debts, delinquent student loans, and parent support. For those who have filed tax returns together with your spouse you might have the right to component or the entire counter.

The law prohibits IRS from using levies/liens in collecting individual duty payments that are shared. But if you owe any shared duty payment, IRS can offset the indebtedness against tax refund due to you personally.

What You Should Do If You Have Back Tax Returns

If you have not filed your back tax returns for several years, you can consult with our BBB A+ rated Brockton tax law business for help.|} Our crew of specialists in Massachusetts is always ready to assist you solve your issues and in addition they’re constantly prepared to answer your questions.

Other Cities Around Brockton We Serve

| Address | Brockton Instant Tax Attorney142 Main St, Brockton, MA 02301 |

|---|---|

| Phone | (617) 500-3822 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Brockton We Serve | Abington, Accord, Acushnet, Allston, Arlington, Arlington Heights, Ashland, Assonet, Attleboro, Attleboro Falls, Auburndale, Avon, Babson Park, Bellingham, Belmont, Berkley, Blackstone, Boston, Braintree, Brant Rock, Bridgewater, Brighton, Brockton, Brookline, Brookline Village, Bryantville, Cambridge, Canton, Carver, Charlestown, Chartley, Chelsea, Chestnut Hill, Cohasset, Dedham, Dighton, Dover, Duxbury, East Boston, East Bridgewater, East Freetown, East Mansfield, East Taunton, East Walpole, East Wareham, Easton, Elmwood, Everett, Fall River, Fayville, Foxboro, Framingham, Franklin, Green Harbor, Greenbush, Halifax, Hanover, Hanscom Afb, Hanson, Hingham, Holbrook, Holliston, Hopedale, Hopkinton, Hull, Humarock, Hyde Park, Jamaica Plain, Kingston, Lakeville, Lexington, Lincoln, Lynn, Malden, Manomet, Mansfield, Marion, Marshfield, Marshfield Hills, Mattapan, Medfield, Medford, Medway, Melrose, Mendon, Middleboro, Milford, Millis, Millville, Milton, Milton Village, Minot, Monponsett, Nahant, Natick, Needham, Needham Heights, New Town, Newton, Newton Center, Newton Highlands, Newton Lower Falls, Newton Upper Falls, Newtonville, Nonantum, Norfolk, North Attleboro, North Carver, North Dighton, North Easton, North Marshfield, North Pembroke, North Scituate, North Waltham, Norton, Norwell, Norwood, Ocean Bluff, Onset, Pembroke, Plainville, Plymouth, Plympton, Quincy, Randolph, Raynham, Raynham Center, Readville, Rehoboth, Revere, Rochester, Rockland, Roslindale, Saugus, Scituate, Seekonk, Sharon, Sheldonville, Sherborn, Somerset, Somerville, South Carver, South Easton, South Walpole, Southborough, Stoneham, Stoughton, Sudbury, Swampscott, Swansea, Taunton, Upton, Waban, Walpole, Waltham, Wareham, Watertown, Waverley, Wayland, Wellesley, Wellesley Hills, West Bridgewater, West Medford, West Newton, West Roxbury, West Wareham, Weston, Westwood, Weymouth, White Horse Beach, Whitman, Winchester, Winthrop, Woburn, Woodville, Wrentham |

| City Website | Brockton Website |

| Wikipedia | Brockton Wikipedia Page |