Finally put an end to the IRS harassment, and get out of paying a large portion of your tax debt

Our BBB A+ rated tax team is here to help you today

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Lynn, and All of Massachusetts

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Need a tax law firm who really knows their stuff? Our experts have hundreds of years combined experience, and are ready to help you

Highly Experienced Lynn Tax Lawyer

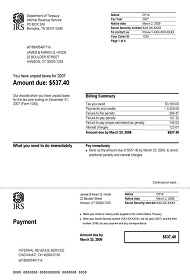

Among the worst things you can do with IRS back tax debt is continue to neglect it for decades at a time. The IRS wants to add on additional penalties and interest costs to the quantity you owe, and certainly will stop at nothing to collect that money.

They are the greatest collection agency on earth, and we firmly believe that no one should have to face them by themselves.

For many people, having a government agency that is huge always harassing them with revenue officers and letters, notices is a dreadful thought.

That is why our Lynn team is here to help you. You will have someone in your corner to help negotiate for you, and no longer have to manage the Internal Revenue Service by yourself.

If you owe the federal government, or the state of Massachusetts, our dedicated law firm is here to make your own life easier.

With only 15 minutes on the telephone with our experts, you will understand what to do, and precisely what you’ll qualify for.

Give our office a call today!

The IRS can legally steal your house or property keep it before it occurs and let our Lynn team fight for you.

Bank levies are charges levied on your Lynn bank account when you’ve outstanding tax debt. The law allows the IRS to seize funds in your bank account for clearing your tax obligations. Regrettably, the procedure isn’t always smooth. In most cases, the association ends up freezing all the money that’s available in a given account for a period of 21 days to take care of a person’s or a company’ tax obligation. During the halt, it’s impossible to get your money. When the interval lapses when they are unfrozen, the sole possibility of getting them at this stage is. Preventing the levy allows you to access your resources for fulfilling with other expenses.

Why and When Bank Levies Get Slapped On

The IRS bank levies are applied to your account as a final resort for you to pay taxes. It occurs to those in Massachusetts who receive demands and many appraisals of the taxes they owe the revenue agency. Failure leaves the IRS with no choice other than to go for your bank account. This happens through communication between your bank as well as the Internal Revenue Service. You may find that on a certain day, if you’re not aware. The amount equal only influences to your tax debt, but it can be more than that and you get a refund after the levy period. A final notice is followed by bank levies for thinking to levy plus a notification about your legal right to a hearing. In short, the Internal Revenue Service notifies you of the bank levies that are pending. When employed, the IRS can just take money that was on the date a levy is implemented in your bank.

How to Have Your Levy Removed in Lynn

There is a window of opportunity for you to use to get rid from your account of bank levies. With a professional service helping out, it will not be difficult that you be aware of when to take your money out of the bank. You can do it by getting into an installment arrangement.

They may be extremely complex to execute while the solution seem simple. You must act quickly, have the resources to do so, understand every aspect of the law and deal with associated bureaucracies imposed by banks along with the IRS. The smart move would be to phone us for professional help by means of your IRS situation. We’ve abilities and expertise that have made us a number one choice for a lot of individuals. For help and more information, contact us for partnered tax professional support.

If your Lynn business has run into payroll or tax problems with the authorities, we can help.

The IRS is a formidable collection machine for the authorities, and they’ll collect, when your business has dropped into IRS or Massachusetts business tax debt. So, in case your business has delinquent taxes such as payroll tax debts there is no need to scurry for cover (and remember – never conceal) even if you know little or nothing about dealing with IRS company tax debts. There are seasoned professionals prepared to help.

Un-Filed Payroll Tax Filings

The Internal Revenue Service looks at payroll tax – taxes imposed on workers and employers – from two views:

- (a) Taxes a company pays the IRS predicated on the wages paid to the worker (known as withholding tax’ and is paid out of the employers own funds) and

- (b) A percentage of wages the company deducts from an employee’s wages and pays it to the IRS.

Tax Repayment Schedule

The program of these payments depends on the average amount being deposited (based on the look back period’ – a twelve month period ending June 30). This payment program may be monthly or semiweekly.

If you are a brand new business and didn’t have some workers during your look back interval’ or in case your total tax liability is up to USD 50,000 for your look back interval’, you must follow a monthly program.

In case your payroll tax liability is less than USD 50,000 you will have to follow a semi-weekly deposit schedule. In the event that you fail to pay your taxes on these days you’ll fall into a payroll tax debt. You must seek the professional services of tax professionals keep from falling into payroll tax debt and to guide you through this maze of processes and prevent substantial fees.

Dealing With Unfiled Tax Debt

Revenue collected through taxes for example payroll tax are spent on financing plans for example; healthcare, social security, unemployment compensation, worker’s compensation and at times to boost local transport that carries many workers to and from work.

When you have to deal with IRS tax debts, it’s extreme important to stay in contact by means of your IRS officials – never avert or conceal from them. Most IRS fees include a compounded interest rate of 14% this can turn a company turtle in an extremely brief time dealing with IRS company tax debt it overriding.

How a Seasoned Lynn Tax Pro Can Help

Being in an IRS business debt situation is serious. You might have time on your side as the IRS is slow to begin processing your account, but when they gain momentum things get worse for you. Nonetheless, you are not helpless. There are processes you might be eligible for that a Massachusetts professional can use his good offices with the Internal Revenue Service to assist you over come your company debts.

Among others, you desire a professional’s help, in the event that you never have heard of an Offer in Compromise, Tax Lien Period, Uncollectible Status and Insolvency. Waste no more time, touch base with us now to get out of business tax debt and save your business from closure.

Has the IRS been sending you notices and letters? Want that to quit immediately? We can assist.

Notices and IRS Letters are sent to those who have not filed their tax returns or have not paid all of their tax obligation. The IRS accounts for collecting taxes due from citizens to make sure that the Federal Government has the money to run its business. The Internal Revenue Service assumes that taxpayers who are delinquent in filing their tax returns and who neglect to pay their taxes are dismissing the reason taxes are important. The IRS also supposes that citizens do not have an excellent reason for not meeting their tax obligations. Competitive pursuit of these citizens is the reason why IRS letters and notices are sent. People who have filed their tax returns but haven’t paid the taxes that are due all, may also get IRS letters and notices. For do speedy group actions delinquent citizens are on the Internal Revenue Service radar. Citizens need to remember the IRS will not need to initiate any court action to levy wages, bank accounts and property. Pension income may be attached.

Penalties are prolific. In 1988, there were only 17 penalties the IRS could levy, but now the distinct of penalties is 10 times that amount. The Internal Revenue Service also has over 75 different letters and notices it can send to individual taxpayers. Some of these can definitely become serious difficulties for the taxpayer.

Examples of Notices

Notice of Low-Reported Tax Debts

A notice that promises their income has been under reported by a taxpayer in Lynn is a serious question. Often, this can be accommodated readily, but the taxpayer will be evaluated interest along with a penalty if the IRS claim is valid. Then the citizen may be accused of filing a fraudulent return, whether this notice spans more than one year of tax filings. The fees as well as the interest will amount to an unbelievable amount of money no matter the perceived intention.

Wage Garnishes

A notice that threatens to attach property, bank account or a taxpayer’s wages is serious. The IRS will send a letter warning of the impending action, and this letter will stipulate an amount of time the taxpayer has to solve the delinquency. This notice follows letters which have been sent to the taxpayer in an effort to resolve the delinquency before it achieves the collection actions.

Notice of Property Lien

A notice saying the IRS has filed a lien on the taxpayer’s property also follows letters of intent to take this action. The notice will include the quantity of the lien and the governmental agency where it was recorded. This lien will prevent the citizen from selling the property until the lien is satisfied, or the lien amount will be deducted from the profits of a sale. The IRS can also induce the sale of the property to acquire satisfaction of the lien. A notice will be issued if a deal is planned.

What you should do because of a notice

The citizen should never discount IRS letters and notices. Rather, they should immediately seek help with these possible hazards to their financial protection. In reality, if a taxpayer who believes they may receive letters and notices from the IRS can contact us so we can stop these from being sent. Contacting our BBB A+ Lynn law firm is even more significant if notice or a letter was received.

Say farewell for good to your IRS back tax returns with a competent Lynn law firm

Have you been fighting for several years with your back tax debts, and are eventually fed up with dealing with the IRS by yourself?

Have they started sending letters and notices to your home or business, demanding you pay interest costs and extra fees for the amount you owe?

If so is hire a tax law business that is reputable and experienced to be by your side each step of the way. The good news is, our Lynn firm is the ideal candidate for the occupation, with an A+ business standing with all the BBB, thousands of satisfied customers throughout the country (notably in exquisite Massachusetts), and our own team of tax lawyers, CPAs and federally enrolled agents, all ready to work on your case today.

The Internal Revenue Service is the biggest collection agency in the world, with a huge number of revenue officers and billions of dollars set aside to pursue good, hard working folks like you for the money you owe. You shouldn’t have to confront them by yourself. We do not get bullied about like normal citizens do, and can use our private contacts to negotiate the settlement that you need.

Using seasoned Lynn legal counsel on your own tax issues is like having a specialist plumber come and fix your massively leaking water main. Certainly you could probably eventually determine just how to fix it by yourself, but by the time you do, your house is probably permanently damaged from leaking, and will cost much more than just hiring the specialist in the very first place.

Our team of experts is standing by, prepared to help you!

A 15 minute consultation with our Lynn team can help potentially save you tens of thousands of dollars

What is an Offer in Compromise Program

Essentially, it describes the kind of understanding between the individual facing the tax problem (tax payer) and the IRS Company which helps the tax payer in this case to settle his or her debt. The customer faced with serious tax issues by paying or instead bailing them out up to less in relation to the amount owed is helped by the Internal Revenue Service. Nonetheless, not all taxpayers that are distressed qualify for IRS Offer in Compromise Agreement. This really is completely after appraisal of the customer has been carried out because qualification is based on several factors. The IRS Offer in Compromise Arrangement has an instrumental role in helping citizens with distressed financial challenges solve their tax problems. What this means is the IRS acts as the intermediary which helps their tax debt is paid by the taxpayer in the most convenient and adaptable mode.

What Does it Take to Qualify?

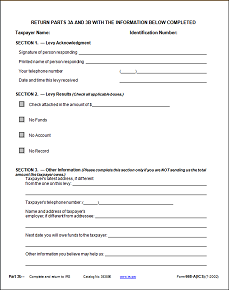

Filling the applications does not ensure the Lynn citizen a qualification that is direct. The IRS begins the total assessment and evaluation procedure that could render you incapable of paying your taxes. The applications should be filled with utmost correctness saying definitely reasons for your inability to pay tax. These applications are then supported with other important records that’ll be utilized by the Internal Revenue Service to determine the qualification of the taxpayer for an Offer in Compromise Deal. However, there are some of the few qualifications procedure that must be fulfilled totally be the citizen. Many of these qualifications include but not limited to ensuring the citizen files all the tax returns that they are legally bound to file, make and present each of the estimated amount of tax payments for the current year and eventually the citizen is designed to make deposits for all the national tax for the current quarter particularly for taxpayers who run companies with employees. These are the three basic tenets of qualification that every taxpayer must meet in order to be considered.

What to Do now

Therefore if you are one of those citizens in need of guidance and care when it comes to IRS our BBB A+ rated tax law firm helping Massachusetts is there for you to help negotiating an IRS Offer in Compromise deal. This really is a fantastic law firm that will serve as a yard stick for individuals who demand suitable help in negotiating for an IRS offer in compromise agreement. Do not hesitate to contact them because they’ve a strong portfolio and a good security reputation. They’ve a team of capable and dynamic professionals who are constantly on hand to help you. Try them today and expertise help like never before. It is just the finest when it comes to negotiation of an IRS offer in compromise agreement.

Other Cities Around Lynn We Serve

| Address | Lynn Instant Tax Attorney85 Exchange St, Lynn, MA 01901 |

|---|---|

| Phone | (617) 500-3822 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Lynn We Serve | Abington, Accord, Acton, Allston, Amesbury, Andover, Arlington, Arlington Heights, Ashland, Auburndale, Avon, Babson Park, Bedford, Belmont, Beverly, Billerica, Boston, Boxborough, Boxford, Braintree, Brighton, Brockton, Brookline, Brookline Village, Bryantville, Burlington, Byfield, Cambridge, Canton, Carlisle, Charlestown, Chelmsford, Chelsea, Chestnut Hill, Cohasset, Concord, Danvers, Dedham, Dover, Dracut, East Boston, East Bridgewater, East Walpole, Essex, Everett, Framingham, Georgetown, Gloucester, Greenbush, Groveland, Hamilton, Hanover, Hanscom Afb, Hanson, Hathorne, Haverhill, Hingham, Holbrook, Hull, Humarock, Hyde Park, Ipswich, Jamaica Plain, Lawrence, Lexington, Lincoln, Littleton, Lowell, Lynn, Lynnfield, Malden, Manchester, Marblehead, Marshfield, Marshfield Hills, Mattapan, Maynard, Medfield, Medford, Melrose, Merrimac, Methuen, Middleton, Millis, Milton, Milton Village, Minot, Nahant, Natick, Needham, Needham Heights, New Town, Newbury, Newburyport, Newton, Newton Center, Newton Highlands, Newton Lower Falls, Newton Upper Falls, Newtonville, Nonantum, North Andover, North Billerica, North Chelmsford, North Marshfield, North Pembroke, North Reading, North Scituate, North Waltham, Norwell, Norwood, Nutting Lake, Ocean Bluff, Peabody, Pembroke, Pinehurst, Prides Crossing, Quincy, Randolph, Reading, Readville, Revere, Rockland, Rockport, Roslindale, Rowley, Salem, Salisbury, Saugus, Scituate, Sharon, Sherborn, Somerville, South Hamilton, South Walpole, Stoneham, Stoughton, Stow, Sudbury, Swampscott, Tewksbury, Topsfield, Tyngsboro, Village Of Nagog Woods, Waban, Wakefield, Walpole, Waltham, Watertown, Waverley, Wayland, Wellesley, Wellesley Hills, Wenham, West Boxford, West Medford, West Newbury, West Newton, West Roxbury, Westford, Weston, Westwood, Weymouth, Whitman, Wilmington, Winchester, Winthrop, Woburn |

| City Website | Lynn Website |

| Wikipedia | Lynn Wikipedia Page |