Stop the harassment from the IRS, and potentially save up to 90% on the money you owe

Give all our BBB A+ rated tax law firm a call right now

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving New Bedford, and All of Massachusetts

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Stop the IRS in their tracks, so you can move on with your financial life

Highly Experienced New Bedford Tax Lawyer

One of many key difficulties that most New Bedford citizens run into in terms of IRS back taxes is feeling concerned and overwhelmed regarding the money that they owe.

We consider that no one should have to go up against the IRS alone.

It is merely not fair what they get regular tax payers through, and we consider they shouldn’t get away with it any longer.

That is for a limited time only, those who are having trouble with back tax debt in the state of Massachusetts, but more particularly New Bedford may qualify for a free 7 Day Free Trial of all our tax relief services. That means you don’t pay a penny for the complete use of our seasoned team for a full week.

30 Day Money Back Guarantee that is on the very top of our no questions asked. In case you aren’t satisfied for any reason with our service, simply let us know within 30 days, and you will get all of your cash back.

What is it that you’re waiting for? The longer that you put it away and wait, the more fees and interest charges the IRS will tack on to the total amount that you just owe. Take actions and call our New Bedford team a call today to get started!

Give our office a call today!

Tax liens can become rather challenging in case you are purchasing or selling your home or property. Let our New Bedford team help you today

What is a lien?

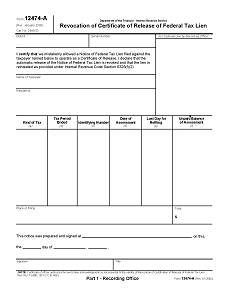

The lien cushions the claim of the authority to all your existing property, inclusive of personal financial and real estate assets. Generally, a federal tax lien is imposed whenever your culpability are analysed by the IRS, when they deliver to you a bill that lays out into detail how much you are owed and additionally when you decline to pay your debts on schedule. Liens normally record the exact amount owed to IRS at the precise time that it’s levied in a public document called the Notice of Federal Tax Lien. The file notifies creditors that the government has a right to confiscate your property at any particular time. This particular info is conventionally obtained by different credit reporting agencies therefore tax liens ultimately reflect on your credit reports. Tax Liens are frequently active ten days after issuing a demand to clear the tax debts that are stipulated.

Federal tax liens can readily be averted from being lodged by paying all your tax dues up and also before the IRS choose to levy a lien in your assets. They may also be evaded through creating installment agreements which sufficiently satisfy the requirements of the IRS as not to file a lien. A federal tax lien can’t be filed if a taxpayer made a decision to prepare a streamlined or guaranteed installment accord. Such agreements require the citizen keep a balance of less than or an amount $10,000 that for the guaranteed payment accord and for the streamlined arrangement , it should be $25,000 or less. In a predicament where the citizen owes more than $25, 000, a tax lien can be averted if he or she a streamlined accord. lays out tries their best to reduce that particular outstanding balance to exactly $25,000 or less and alternatively There are two methods of removing tax liens: withdrawal and release.

How can I have my tax lien wiped away?

Withdrawing federal tax liens is like it never existed when the IRS resort to revoking the lien. Whenever the lien is filled erroneously lien withdrawals normally take place. In a case where the tax lien is wrongly filed, contact the IRS as soon as possible. In order to substantiate that you have no tax arrears then take the essential measures in withdrawing the lien the IRS agents will check your account.

Releasing a national or Massachusetts state tax lien normally means that your assets are no longer constrained by the imposed lien. Immediately after lien releasing, the county records will immediately be brought up to date to show that is has been released. Yet,the presence of a federal tax lien will be shown in your credit reports for 10 years. Liens are often released within a month of clearing the outstanding tax arrears or upon establishing the deals that were guaranteed and streamlined.

What to Do Next

Avoid being conned by a Massachusetts tax aid company, and let our BBB A Rated team help you

Many people are law abiding New Bedford citizens and they fear the threats of IRS action. Innocent individuals are lured by these companies into their scams and commit consumer fraud and even larceny! Thus, you must exercise care when you are trying to locate a tax resolution firm for yourself.

What Scammy Companies will do

Not all Massachusetts tax relief companies who promise to negotiate with the IRS for you’re trustworthy. Since there are all those deceptive companies out there, therefore, averting IRS tax help scams is vitally important. It’s likely to prevent being taken advantage of, all you need to do to follow a couple of hints that are useful and would be to educate yourself in this respect! A tax resolution company that is genuine will consistently folow a mutually acceptable financial arrangement wherein the payments could be made on a weekly, bi-weekly or monthly basis.

Secondly, it is advisable to be quite attentive when you are picking a specific tax resolution firm to work with. Chances are the business is deceptive should they guarantee you the desired results or state that you qualify for any IRS plan without going through a complete financial analysis of your current situation then. After all, it’s not possible for firms to pass such judgment without going through your all-inclusive fiscal evaluation first. So, don’t fall for their sugar-coated promises and search for other authentic companies instead.

How to research the company

The internet is a storehouse of info, but you must be careful about using such advice. For handling your tax related difficulties, do not just hire any haphazard business with great ads or promotional campaigns. Thus, doing your homework and investing time in research is certainly a sensible move here.

A website that has an excellent rating on BBB is definitely one that you could place your trust in. We are a BBB A+ rated New Bedford company, we help individuals by relieving their IRS back tax debts. Our tax alternatives are reasonable, we do not just negotiate for your benefit with the Internal Revenue Service, but instead produce a practical strategy first in order to make sure that your tax debts are eliminated. We do all the hard work for you while you concentrate on other important elements of your life. Thanks to our vast experience and expertise in the field, you can rest assured your tax problems would be solved efficiently and quickly when you turn to us for help.

Has your business run into problems with unpaid payroll or company taxes? Our New Bedford business can help.

The Internal Revenue Service is a formidable collection machine for the Federal Government, and in case your New Bedford company has dropped into IRS or Massachusetts company tax debt, they will gather. Thus, if your business has delinquent taxes for example payroll tax debts there isn’t any need to scurry for cover (and remember – never conceal) even in the event you know little or nothing about coping with IRS company tax debts. There are experienced professionals ready to help.

Un-Paid Payroll Taxes

The Internal Revenue Service looks at payroll tax – taxes imposed on employers and employees – from two perspectives:

- (a) Taxes an employer pays the IRS predicated on the wages paid to the worker (known as withholding tax’ and is paid out of the companies own funds) and

- (b) A percentage of wages the employer deducts from an employee’s wages and pays it to the Internal Revenue Service.

The company ends up footing the bill for both the types of taxes as the withholding tax results in lower wages.

Tax Repayment Timeline

Employment or Payroll taxes are collected by the IRS through the Electronic Federal Tax Payment System (EFTPS). The schedule of these payments depends on the average sum being deposited (based on the look back period’ – a twelve month period ending June 30). This payment program may be monthly or semiweekly.

In the event that you are a new company and didn’t have any workers during your look back interval’ or in case your overall tax liability is up to USD 50,000 for your look back period’, you must follow a monthly program. Your payroll taxes should be deposited by the 15th of the month following the last payday.

If your payroll tax liability is less than USD 50,000 you will have to follow a semiweekly deposit program. You will fall into a payroll tax debt should you don’t pay your taxes on these days. You need to seek the professional services of tax professionals to guide you through this maze of procedures and keep from falling into payroll tax debt and steer clear of significant fees.

Dealing With Unfiled Tax Debt

Revenue collected through taxes including payroll tax are spent on capital plans such as; healthcare, social security, unemployment compensation, worker’s compensation and at times to enhance local transfer that carries many workers to and from work.

When you have to take care of IRS tax debts, it’s extreme important to stay in contact by means of your IRS officials – never avert or hide from them. Most IRS penalties include a compounded rate of interest of 14% this can turn a business turtle in an extremely short time dealing with IRS company tax debt it overriding.

How a Seasoned New Bedford Tax Expert Can Assist

Being in an IRS company debt situation is serious. You might have time on your side since the IRS is slow to start processing your account, but when they gain impetus things get worse for you. Yet, you aren’t helpless. There are procedures you may be qualified for that a Massachusetts professional can use his good offices with the Internal Revenue Service to assist you over come your company debts.

If you haven’t learned of an Offer in Compromise, Tax Lien Span, Uncollectible Status and Insolvency, among others, you are in need of a New Bedford professional’s help. Waste no more time, touch base with us now to get out of business tax debt and save your company from close.

An experienced law firm is your best shot of eventually being free of back tax debts in Massachusetts

Have you ever been fighting with your back tax debts for several years, and are finally fed up with dealing with the Internal Revenue Service by yourself?

Have they started sending letters and notices to your residence or company, demanding you pay interest costs and additional penalties for the amount you owe?

If so, the best thing you can do is hire a reputable and experienced tax law firm to be by your side every step of the way. The great news is, our New Bedford firm is the right candidate for the occupation, with an A+ business rating with all the BBB, tens of thousands of satisfied clients throughout the nation (especially in delightful Massachusetts), and our own team of tax lawyers, CPAs and federally enrolled agents, all ready to work on your case today.

The IRS is the largest collection agency on the planet, with thousands of billions and revenue officers of dollars set aside to chase good, hard working folks like you for the money you owe. You shouldn’t have to face them by yourself. We do not get intimidated about like ordinary citizens do, and can use our private contacts to negotiate the settlement that you need.

Using seasoned New Bedford legal counsel on your own tax problems is like having an expert plumber come and fix your massively leaking water main. Certainly you could probably finally find out the best way to fix it by yourself, but by the time you do, your house is most likely permanently damaged from leaking, and certainly will cost much more than simply hiring the specialist in the first place.

So do your future, your family and yourself a and let our New Bedford law firm help you with your back tax issues immediately. Our team of specialists is standing by, ready to help you today!

Imagine notices and letters being sent to your New Bedford dwelling or company. Our team can help.

Notices and IRS Letters are sent to individuals in New Bedford who haven’t paid all of their tax obligation or have not filed their tax returns. The Internal Revenue Service is responsible for collecting taxes due from citizens to make sure the Federal Government has the funds to run its business. The Internal Revenue Service assumes that taxpayers who are delinquent in filing their tax returns and who fail to pay their taxes are ignoring the reason why taxes are significant. The IRS also supposes that taxpayers would not have an excellent rationale for not meeting their tax obligations. Competitive pursuit of these citizens is the reason why IRS letters and notices are sent. Individuals who have filed their tax returns but haven’t paid all of the taxes which are due, will also get IRS letters and notices. For executing fleet group action delinquent citizens are on the IRS radar. Taxpayers need to remember that the IRS does not have to initiate any court actions to impose wages, bank accounts and property. Pension income can be attached.

Many IRS letters and notices are sent to inflict a penalty on the taxpayer. Penalties are prolific. In 1988, there were just 17 fees that the IRS could impose, but now the different of penalties is 10 times that number. The IRS also has over 75 distinct letters and notices it can send to individual taxpayers. Some of these can certainly become serious issues for the taxpayer.

Some Examples of Notices

Notice of Low-Reported Tax Debts

A notice that asserts a taxpayer has under reported their income is a serious matter. Frequently, this could be reconciled readily, but the citizen will be assessed a penalty plus interest if the IRS claim is valid. Then the citizen could be accused of filing a fraudulent return, if this notice crosses more than one year of tax filings. The interest and the penalties will amount to an unbelievable sum of money irrespective of the perceived purpose.

Wage Garnishing

A notice that threatens to attach property, bank account or a taxpayer’s wages is serious. The IRS will send a letter warning of the forthcoming actions, and this letter will stipulate a period of time that the citizen has to resolve the delinquency. Letters that have been sent to the taxpayer in an effort to solve the delinquency before it achieves the collection activity are followed by this notice.

Property Liens

A notice saying the IRS has filed a lien on the citizen’s property also follows this actions to be taken by letters of intent. The notice will contain the quantity of the governmental bureau and also the lien where it was recorded. This lien will avoid the citizen from selling the property until the lien is filled, or the lien amount will be deducted from the proceeds of a deal. The Internal Revenue Service may also force the selling of the property to acquire fulfillment of the lien. If a deal is planned, a notice will be issued.

What to do because of a notice

The citizen should never disregard IRS letters and notices. Instead, they should immediately seek help with these potential risks to their financial protection. Actually, if a citizen who believes they may receive letters and notices from the IRS can contact us so we can stop these from being sent. Contacting our BBB A+ New Bedford law firm is even more significant if notice or a letter was received. We have many years of successful experience in working with the Internal Revenue Service and state of Massachusetts to resolve taxpayer problems.

Other Cities Around New Bedford We Serve

| Address | New Bedford Instant Tax Attorney555 Pleasant St, New Bedford, MA 02740 |

|---|---|

| Phone | (617) 500-3822 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around New Bedford We Serve | Acushnet, Assonet, Attleboro, Attleboro Falls, Berkley, Bridgewater, Bryantville, Buzzards Bay, Carver, Cataumet, Chartley, Chilmark, Cotuit, Cuttyhunk, Dartmouth, Dighton, East Bridgewater, East Falmouth, East Freetown, East Mansfield, East Sandwich, East Taunton, East Wareham, Easton, Edgartown, Elmwood, Fairhaven, Fall River, Falmouth, Forestdale, Halifax, Hanson, Kingston, Lakeville, Manomet, Mansfield, Marion, Marstons Mills, Mashpee, Mattapoisett, Menemsha, Middleboro, Monponsett, Monument Beach, New Bedford, North Carver, North Dartmouth, North Dighton, North Falmouth, Norton, Oak Bluffs, Onset, Osterville, Plymouth, Plympton, Pocasset, Raynham, Raynham Center, Rehoboth, Rochester, Sagamore, Sagamore Beach, Sandwich, Seekonk, Silver Beach, Somerset, South Carver, South Dartmouth, South Easton, Swansea, Taunton, Vineyard Haven, Wareham, West Barnstable, West Bridgewater, West Chop, West Falmouth, West Tisbury, West Wareham, Westport, Westport Point, White Horse Beach, Woods Hole |

| City Website | New Bedford Website |

| Wikipedia | New Bedford Wikipedia Page |