The right tax law firm can make the difference between paying all of your debt, or only a small portion of it

We can show you how to save a ton, sometimes up to 90%

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Quincy, and All of Massachusetts

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Our BBB A+ rated law firm is standing by, ready to assist you right away

Highly Experienced Quincy Tax Lawyer

Among the key difficulties that Quincy citizens run into in terms of IRS back taxes is feeling overwhelmed and concerned regarding the money that they owe. With the IRS taking away cash, property and assets, and even sending threatening letters and notices, revenue officers, it can be an extremely chilling experience.

We consider that no one should need to go up against the IRS alone anymore.

It is just not fair what they get regular tax payers through, and we believe they shouldn’t get away with it any longer.

That means you do not pay a penny for the full use of our experienced team for a full week.

That is on top of our no questions asked 30 Day Money Back Guarantee. In case you aren’t satisfied for any reason with our service, just let us know within 30 days, and you will get all of your cash back.

What are you looking forward to? The longer that you put it off and wait, the more penalties and interest costs the IRS will tack on to the quantity that you just owe. Take action and call our Quincy team a call today to get started!

Give our office a call today!

Let our Quincy team enable you to remove a wage garnishment quickly, and get back your hard earned cash.

What is a Garnishment?

Should you owe the IRS back taxes and don’t respond to payment notices or their phone calls chances are that you may be subjected to an IRS wage garnishment. In other quarters, it’s also known as wage attachment or a wage levy. It is worth noting that a court order is generally not needed and other state and federal laws pertaining to the total amount of exempted from garnishment does provide several exceptions for the wage levies.

The garnishment process is usually quite drawn-out, first the IRS determines how much you owe them in back taxes, once this has been done, they’ll send you several payment request notices in the mail in addition to more than a single phone call with regards to the debt in question. You normally have thirty (30) days to touch base with IRS with regards to this notice before they proceed and forwarding the notice to your Quincy company. Once this notice was sent to the Quincy company, you have a further fourteen (14) days to make an answer before garnishment of wages begins. The company typically has at least one pay period after receiving a notice of levy before they may be required to send the funds.

How Much Can they Garnish from My Paychecks?

IRS garnishment rules typically permit the Internal Revenue Service garnish or to deduct 70% or more of an employee’s wages; this is mostly done with the aim of convincing his representative or the employee to touch base with IRS to settle the debt.

Wage garnishments are usually one of the most aggressive and severe tax collection mechanisms and one should never take them lightly, as a matter of fact, they’d rather resolve tax issues otherwise and only sanction this levy when they feel they’ve ran out of workable alternatives. Even though paying off the taxes you owe the IRS is the simplest way out of such as situation, this is generally not possible due to a wide array of motives. First of all, you may not possess the tax liability or the whole amount may belong to somebody else or your ex spouse, you may be asked to show this though.

What should I do because of a wage garnishment?

You therefore have to discuss any payment arrangements with the Internal Revenue Service and do fairly fast. In this regard, it is critical that you get in touch with an expert who’ll enable you to readily get a wage garnishment discharge and quit or end the garnishment. We’re a Quincy BBB A+ rated tax company using a team of tax attorneys that are exceptionally qualified with years of expertise and also a long list of satisfied clients to establish this. Get in touch with us and we guarantee to get back to you within the least time possible, usually within one working day or less.

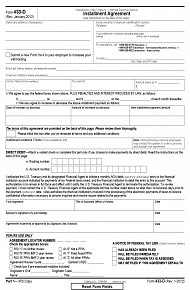

An Installment Agreement can spread your payments out over time, so you don't have to pay all at once

This arrangement allows for monthly payments to be made. So long as their tax debt is paid by the taxpayer in full under this particular Agreement, they avoid the payment of the fee that’s associated with creating the Arrangement and can reduce or get rid of the payment of interest and penalties. Establishing an IRS Installment Agreement requires that all necessary tax returns have been filed before applying for the Understanding. The citizen cannot have some unreported income. Individual citizens who owe $50,000 or less in combined individual income tax including penalties and interest can receive 72 months the sum of tax owed .

Good Things about an Payment Plan

The agreement will bring about a few significant gains for the taxpayer. While an arrangement is in effect enforced collection action will never be taken. Life will be free of IRS letters and notices. There’ll be more fiscal freedom when the citizen can count on paying a set payment every month rather than having to be worried about getting lump sum amounts on the tax debt. The taxpayer will remove interest and continuing IRS fees. The Internal Revenue Service will assist the citizen keep the agreement in force in the event the taxpayer defaults on a payment providing the IRS is notified instantly.

Obligations of the Installment Plan

Some duties have the Installment Agreement. When due, the minimum monthly payment must be made. The income of an individual citizen or the incomes of citizens that were combined must be disclosed when putting in an application for an Installment Agreement. In some cases, a financial statement should be supplied. All future returns should be filed when due and all the taxes owed with these returns should be paid when due. Taxpayers paying their tax debt under an Installment Agreement may be required to authorize direct debit of their checking account. This way of making monthly payments enable the taxpayer to request the lien notice be withdrawn. In the event the taxpayer defaults on the Installment Agreement, but, the lien can be reinstated.

An Installment Agreement can be negotiated by the citizen with the Internal Revenue Service. Nonetheless, particular advice should be supplied and any advice might be subject to confirmation. For taxpayers owing more than $50,000, a financial statement will be required.

How to Prepare to Apply for an Installment Agreement

There are some precautions that should be considered, while taxpayers can apply for an IRS Installment Agreement. Though the IRS tries to make using for an Installment Agreement a relatively simple process, there are some condition which can make this a challenging job. It is crucial to get it right the first time that the application is made, since many problems can be eliminated by an Installment Agreement with the Internal Revenue Service.

We’re the BBB A+ rated law firm serving all of Quincy and Massachusetts, that may provide you with expert support. Our many years of experience working with the Internal Revenue Service on behalf of Quincy citizens who have problems paying their tax debt qualifies us to ensure acceptance of your application for an Installment Agreement.

An Offer in Compromise agreement could save you up to 90% on your back tax debts

What is an Offer in Compromise Program

Basically, it describes the type of deal between the person facing the tax difficulty (tax payer) and also the IRS Business which helps the tax payer in this case to settle his or her debt. The IRS helps the client faced with serious tax problems bailing them out up to less compared to the amount owed or rather by paying. Nevertheless, not all troubled citizens qualify for IRS Offer in Compromise Agreement. This is completely because qualification is based on several variables after appraisal of the client has been carried out. The IRS Offer in Compromise Deal plays an instrumental role in helping taxpayers with distressed financial challenges solve their tax problems. This implies the IRS functions as the intermediary which helps their tax debt is paid by the taxpayer in the most convenient and adaptable manner. The main interest and point of focus is the compromise that perfectly satisfies the needs of both the taxpayer as well as the Internal Revenue Service (IRS).It’s advisable to note the citizen must make a valid and appropriate offer vis-a-vis what the IRS considers their sincere and precise potential to pay.

How Hard is it to Qualify for an OIC agreement?

Filling the applications doesn’t guarantee the Quincy taxpayer a qualification that is direct. The Internal Revenue Service begins the entire assessment and evaluation process that may render you incapable of paying your taxes. These programs are then supported with other applicable documents that’ll be used by the Internal Revenue Service to ascertain the qualification of the citizen for an Offer in Compromise Agreement. However, there are some of the few qualifications process that has to be fulfilled totally be the citizen. These are the three basic tenets of qualification that each taxpayer seeking help from IRS must meet in order to be considered.

What to do now

This really is an amazing law firm that may serve as a yard stick for all those who require proper help in negotiating for an IRS offer in compromise arrangement. Don’t hesitate to contact them because they have a great security reputation and a strong portfolio. They have a team of dynamic and capable professionals who are always on hand to assist you. Try them today and expertise help like never before. It is simply the greatest when it comes to negotiation of an IRS offer in compromise arrangement.

By having interest charges and the fees removed, you could reduce your tax debt by 50% immediately simply

Once the IRS hit on you or your company with a tax bill, it normally appends penalties and interest charges. These additional costs may be horrific such that an old tax bill could have double in interest and penalties pinned onto it. Some penalties, like late payments, they are included by IRS computers. Otherwise, penalties may be inflicted by IRS staff like filing a late return, if you dishonored a tax code provision.

The IRS assumes you acknowledge them, in the event that you do not whine once penalties are imposed. Fortunately, the IRS can confiscate a penalty just as simple as it comprised one. The key to the realm of the tax penalty relief is revealing a sensible reason for your letdown to mind with tax law.

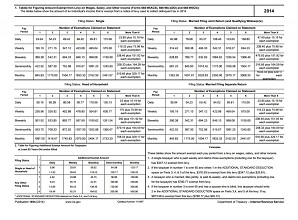

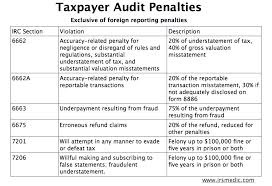

The total amount of tax code fines that are different is staggering. Here are some of the penalties that IRS will tack on to the debts of people who’ve not filed their tax debts that are overdue.

Incorrectness:

The IRS will impose a 20 % fee on you if you were unreasonably negligent or greatly minimized your taxes. This precision-connected fine is used when you are unable to set a tax write-off in a review, or you did not submit all of your income as well as it is learnt by the IRS.

Civil deceit:

A fee 75% can be attached in case the Internal Revenue Service finds that you were not reported your income with a deceitful intention.

Delayed Payment:

Usually, the Internal Revenue Service will add a penalty from 0.25 % to 1% for each month to an income tax statement, which isn’t paid punctually. Fines for failing to make payroll tax deposits punctually are substantially elevated.

Not Filing on time:

If you did not file your return punctually, the IRS can fine you an additional 5% per month on any outstanding balance. However, this punishment can be implemented just for the initial five months after the due date of the return, equal to a 25% higher cost. If there’s no outstanding balance, the IRS can nevertheless visit lesser penalties.

Once you know how as well as the reason the IRS hit fines against you, you may require that they eliminated or be abridged. The IRS name for this particular process is called an abatement. Approximately one-third of all tax penalties are ultimately abated, and it’s going to not be less should you know the approaches to fight them.

Only telling the IRS that you cannot manage to compensate it, or do not like a fee, will not work. You need to show reasonable cause, which means a supplication that is good. In line with the IRS, any sound cause advanced by a citizen as the reason for postponement in filing a return, making deposits, or paying tax when owed will be cautiously examined.

Methods to request for interest abatement and an IRS penalty

Once you get a tax notice with tax penalties, submit your request for abatement in writing, following a filled form up, but be brief and clear cut.

Enclose these documents with your written request.

- Letter from a registered medical practitioner, describing your condition that prevented you from filing your tax return on time.

- Death certificate substantiating the bereavement of your blood or close relationships.

- A detailed report from the fire division if your property is damaged due to fire.

What to Do Next

When you have been levied penalties by the Internal Revenue Service, there are a few easy and effective ways to get interest condensed or your tax fines or eliminated entirely. We’ve really been for a long time in the industry and we’re dedicated to offer our customers a professional IRS penalty and interest abatement service legitimately. Contact us today to solve your tax problems all and the related fees imposed by the Internal Revenue Service on you or on your own Quincy business.

Avoid being scammed by a Massachusetts tax relief company, and let our BBB A Rated team help you

Most people are law abiding Quincy citizens and they dread the risks of IRS action. These businesses lure innocent individuals into their scams and commit even and consumer fraud theft! Therefore, you must exercise care when you are attempting to locate a tax resolution firm for yourself.

What Tax Relief Scams can do

Not all Massachusetts tax relief companies who promise to negotiate together with the IRS for you’re trustworthy. Because there are so many deceitful businesses out there, thus, averting IRS tax help scams is vitally significant. It is not impossible to avoid being taken advantage of, all you have to do to follow a number of useful suggestions and would be to train yourself in this respect! A tax resolution firm that is genuine will consistently folow a mutually acceptable financial arrangement wherein the payments could be made on a weekly, bi-weekly monthly or basis.

Secondly, it’s advisable to be somewhat attentive when you are choosing a special tax resolution firm to work with. Chances are the company is deceptive if they assure you the desired outcomes or state that you qualify for any IRS program without going through a complete fiscal analysis of your current situation then. After all, without going through your all-inclusive fiscal investigation first, it is not possible for businesses to pass such judgment. So, don’t fall for their sugar-coated promises and hunt for other firms that are genuine instead.

How to find out about the company

The internet is a storehouse of info, but you have to be cautious about using such information. Do not just hire any haphazard business with good advertisements or promotional campaigns for handling your tax associated difficulties. In order to pick the right firm, it is best to study about the same in the Better Business Bureau web site and see their ratings or reviews. So, doing your homework and investing time in research is definitely a shrewd move here.

A site with a great rating on BBB is unquestionably one you could place your trust in. We are a BBB A+ rated Quincy company, we help individuals by relieving their IRS back tax debts. Our tax alternatives are sensible, to be able to make sure that your tax debts are eliminated, we do not just negotiate together with the Internal Revenue Service on your own behalf, but rather develop a practical strategy first. Due to our vast experience and expertise in the field, you can rest assured that your tax problems would be resolved quickly and efficiently when you turn for help to us.

Other Cities Around Quincy We Serve

| Address | Quincy Instant Tax Attorney15 Cottage Ave, Quincy, MA 02169 |

|---|---|

| Phone | (617) 500-3822 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Quincy We Serve | Abington, Accord, Acton, Allston, Andover, Arlington, Arlington Heights, Ashland, Attleboro, Attleboro Falls, Auburndale, Avon, Babson Park, Bedford, Bellingham, Belmont, Berkley, Beverly, Billerica, Blackstone, Boston, Braintree, Brant Rock, Bridgewater, Brighton, Brockton, Brookline, Brookline Village, Bryantville, Burlington, Cambridge, Canton, Carlisle, Carver, Charlestown, Chartley, Chelsea, Chestnut Hill, Cohasset, Concord, Danvers, Dedham, Dighton, Dover, Duxbury, East Boston, East Bridgewater, East Mansfield, East Taunton, East Walpole, Easton, Elmwood, Everett, Fayville, Foxboro, Framingham, Franklin, Green Harbor, Greenbush, Halifax, Hamilton, Hanover, Hanscom Afb, Hanson, Hathorne, Hingham, Holbrook, Holliston, Hopedale, Hopkinton, Hudson, Hull, Humarock, Hyde Park, Jamaica Plain, Kingston, Lakeville, Lexington, Lincoln, Lynn, Lynnfield, Malden, Manchester, Mansfield, Marblehead, Marlborough, Marshfield, Marshfield Hills, Mattapan, Maynard, Medfield, Medford, Medway, Melrose, Mendon, Middleboro, Middleton, Milford, Millis, Milton, Milton Village, Minot, Monponsett, Nahant, Natick, Needham, Needham Heights, New Town, Newton, Newton Center, Newton Highlands, Newton Lower Falls, Newton Upper Falls, Newtonville, Nonantum, Norfolk, North Attleboro, North Billerica, North Carver, North Dighton, North Easton, North Marshfield, North Pembroke, North Reading, North Scituate, North Waltham, Norton, Norwell, Norwood, Nutting Lake, Ocean Bluff, Peabody, Pembroke, Pinehurst, Plainville, Plymouth, Plympton, Prides Crossing, Quincy, Randolph, Raynham, Raynham Center, Reading, Readville, Revere, Rockland, Roslindale, Salem, Saugus, Scituate, Sharon, Sheldonville, Sherborn, Somerville, South Easton, South Hamilton, South Walpole, Southborough, Stoneham, Stoughton, Stow, Sudbury, Swampscott, Taunton, Tewksbury, Topsfield, Village Of Nagog Woods, Waban, Wakefield, Walpole, Waltham, Watertown, Waverley, Wayland, Wellesley, Wellesley Hills, Wenham, West Bridgewater, West Medford, West Newton, West Roxbury, Weston, Westwood, Weymouth, Whitman, Wilmington, Winchester, Winthrop, Woburn, Woodville, Wrentham |

| City Website | Quincy Website |

| Wikipedia | Quincy Wikipedia Page |